Small Business Bookkeeping Software: Your Path to Financial Clarity and Growth

Related Articles: Small Business Bookkeeping Software: Your Path to Financial Clarity and Growth

- The Ultimate Guide To The Best Online Business Schools In The US

- Best Online Businesses To Start In 2024: Reddit’s Top Picks

- The Ultimate Guide To Finding The Best Online Business DP For Girls: Level Up Your Brand!

- The Ultimate Guide To Online-Only Business Bank Accounts: Find Your Perfect Match

- Your Money, Your Rules: Finding The Best Online Business Savings Account

With great pleasure, we will explore the intriguing topic related to Small Business Bookkeeping Software: Your Path to Financial Clarity and Growth. Let’s weave interesting information and offer fresh perspectives to the readers.

Small Business Bookkeeping Software: Your Path to Financial Clarity and Growth

Let’s face it, running a small business can be a whirlwind of activity. You’re juggling customer needs, managing inventory, marketing your brand, and keeping a watchful eye on your finances. It’s a lot to handle, and frankly, bookkeeping often gets pushed to the back burner.

But here’s the thing: your finances are the lifeblood of your business. Without a clear understanding of your income, expenses, and cash flow, you’re essentially flying blind. You might be making decisions based on gut feeling rather than solid data.

This is where small business bookkeeping software comes in. It’s like having a personal financial advisor at your fingertips, helping you streamline your accounting processes, gain valuable insights into your business performance, and make informed decisions that drive growth.

Why Small Business Bookkeeping Software is Essential

Imagine this: you’re trying to balance your checkbook manually. You’re sifting through receipts, struggling to reconcile bank statements, and constantly wondering if you’re missing something. It’s a tedious and time-consuming process, right?

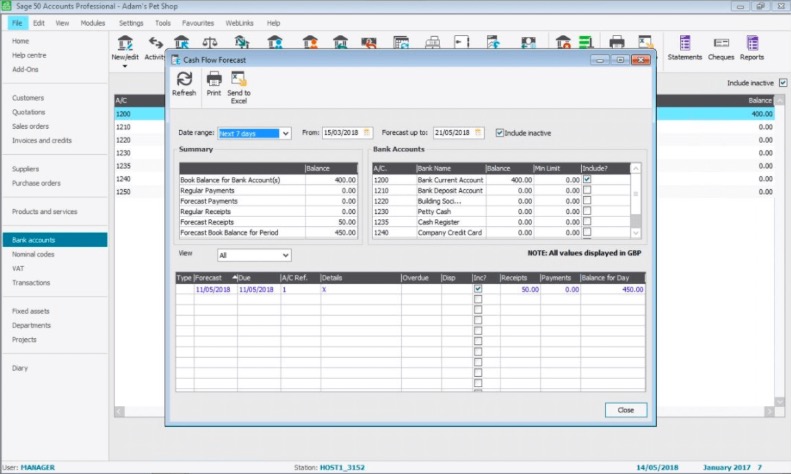

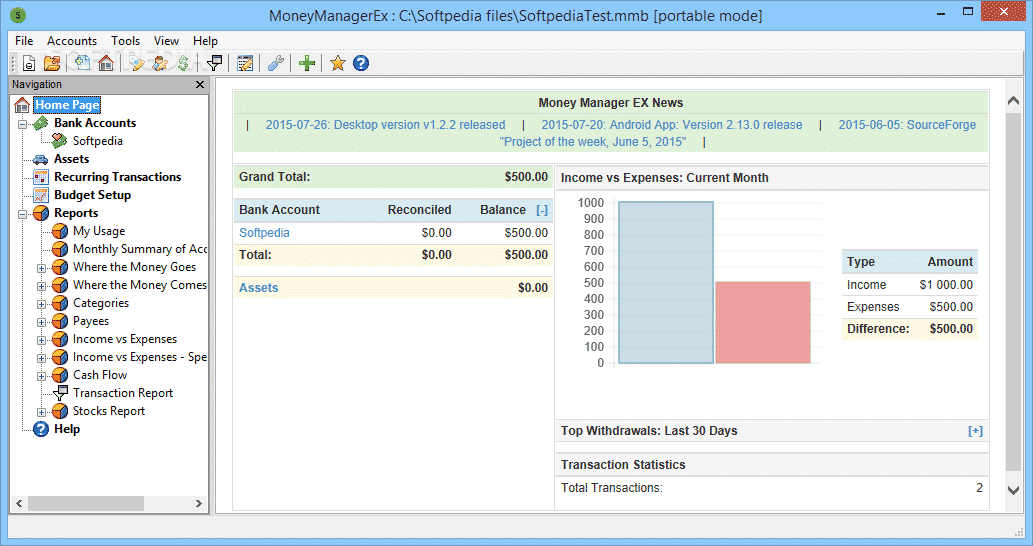

Now, picture this: you have a user-friendly software solution that automates all those tasks. You can easily track your income and expenses, reconcile bank transactions, generate financial reports, and even send invoices with just a few clicks. That’s the power of small business bookkeeping software.

Here’s why it’s a game-changer for your business:

- Saves you time and money: No more wasting hours on manual data entry and reconciliation. The software does the heavy lifting, freeing up your time to focus on other aspects of your business.

- Provides real-time insights: You’re not just looking at historical data; you’re getting up-to-the-minute information about your financial performance. This allows you to make informed decisions based on current trends.

- Improves accuracy and efficiency: Say goodbye to human errors. The software handles all the calculations, ensuring your financial records are accurate and reliable.

- Simplifies tax preparation: The software automatically generates reports that are tax-ready, making tax season a breeze.

- Boosts your productivity: With streamlined accounting processes, you can focus on growing your business and reaching your goals.

Choosing the Right Bookkeeping Software for Your Business

With so many options available, choosing the right bookkeeping software can feel overwhelming. Here are some key factors to consider:

- Your business size and complexity: If you’re a sole proprietor with simple transactions, you might not need a feature-rich solution. But if you have a growing team and complex financial processes, you’ll need a more robust software.

- Your budget: Bookkeeping software comes in a range of price points. Make sure you choose a solution that fits your budget and offers the features you need.

- Ease of use: The software should be user-friendly, even if you’re not an accounting expert. Look for intuitive interfaces and helpful tutorials.

- Mobile access: You should be able to access your financial information from anywhere, anytime. Look for software with mobile apps.

- Integrations: Can the software integrate with other tools you use, such as your bank account, e-commerce platform, or payroll system?

Popular Small Business Bookkeeping Software Options

Let’s explore some of the top-rated bookkeeping software options for small businesses:

1. QuickBooks Online: A popular choice for its ease of use, robust features, and affordability. It offers a range of plans to suit different business needs.

2. Xero: Known for its user-friendly interface and powerful reporting capabilities. It’s a great option for businesses that need to track multiple currencies or have a global presence.

3. FreshBooks: A popular choice for freelancers and small businesses. It offers a clean interface, excellent customer support, and a focus on invoicing and expense tracking.

4. Zoho Books: A comprehensive solution that offers a wide range of features, including inventory management, project tracking, and CRM.

5. Wave Accounting: A free option that’s perfect for small businesses with basic needs. While it’s free for basic accounting, it offers paid plans for more advanced features.

Tips for Getting the Most Out of Your Bookkeeping Software

Once you’ve chosen your software, here are some tips to maximize its benefits:

- Set up your account properly: Take the time to categorize your accounts, set up your chart of accounts, and link your bank accounts. This will ensure that your data is accurate and organized from the start.

- Use the software regularly: Don’t let your bookkeeping pile up. Make it a habit to enter your transactions regularly, whether it’s daily, weekly, or monthly.

- Run regular reports: Use the software’s reporting capabilities to track your income, expenses, and cash flow. This will help you identify trends and make informed decisions.

- Take advantage of automation: Many bookkeeping software solutions offer automation features, such as automated bank reconciliation and invoice generation. Take advantage of these features to save time and effort.

- Get training: If you’re not sure how to use all the features of your software, don’t hesitate to seek out training or support.

The Power of Bookkeeping Software: A Case Study

Let’s look at a real-life example. Sarah, a freelance graphic designer, used to struggle with keeping track of her finances. She relied on spreadsheets and manual calculations, which often led to errors and frustration. She was also unsure about her profitability and struggled to make informed decisions about pricing and investments.

Then, she discovered QuickBooks Online. She was amazed by how easy it was to use and how much time it saved her. She could track her income and expenses, generate reports, and even send invoices with a few clicks.

With the insights provided by QuickBooks Online, Sarah was able to:

- Increase her prices: By analyzing her expenses, she realized that she was undercharging for her services. She increased her prices and saw a significant boost in her revenue.

- Invest in new equipment: She used the software’s reports to track her cash flow and make an informed decision to invest in a new computer and software. This improved her productivity and allowed her to take on more clients.

- Make better business decisions: She was able to see trends in her income and expenses, which helped her make informed decisions about her business, such as when to hire a part-time assistant or explore new markets.

Sarah’s story is a testament to the power of small business bookkeeping software. It can help you take control of your finances, gain valuable insights, and make better decisions that drive growth.

Addressing Potential Counterarguments

"I don’t have time for bookkeeping software."

While it’s true that setting up and learning a new software takes some time, the time you save in the long run far outweighs the initial investment. Plus, most software solutions are user-friendly and offer tutorials to help you get started.

"I’m not tech-savvy."

Many bookkeeping software solutions are designed for people with little or no accounting experience. They have intuitive interfaces, helpful tutorials, and excellent customer support.

"My business is too small for bookkeeping software."

Even if you’re a sole proprietor, bookkeeping software can help you stay organized, track your finances, and make informed decisions. There are free and affordable options available that are perfect for small businesses.

Conclusion

In the fast-paced world of small business, financial clarity is essential for survival and growth. Small business bookkeeping software is a powerful tool that can help you achieve that clarity. It simplifies your accounting processes, provides real-time insights, and empowers you to make informed decisions that drive your business forward.

Don’t let bookkeeping be a burden. Embrace the power of technology and invest in a solution that will help you achieve your financial goals.

FAQs

1. What is the best bookkeeping software for small businesses?

The best software depends on your specific needs and budget. Some popular options include QuickBooks Online, Xero, FreshBooks, Zoho Books, and Wave Accounting.

2. How much does bookkeeping software cost?

Prices vary depending on the software and the features you need. Some offer free plans, while others have monthly or annual subscriptions.

3. Is bookkeeping software difficult to use?

Most bookkeeping software is designed to be user-friendly, even if you’re not an accounting expert. They have intuitive interfaces and helpful tutorials.

4. Can I access my bookkeeping software on my phone?

Many bookkeeping software solutions offer mobile apps, allowing you to access your financial information from anywhere, anytime.

5. How can I learn more about bookkeeping software?

You can visit the websites of different software providers, read reviews, or consult with an accountant to get recommendations.

Closure

Thus, we hope this article has provided valuable insights into Small Business Bookkeeping Software: Your Path to Financial Clarity and Growth. We hope you find this article informative and beneficial. See you in our next article!