Small Business Depreciation: Your Guide to Tax Savings in 2024

Related Articles: Small Business Depreciation: Your Guide to Tax Savings in 2024

- Best Online Businesses To Start In 2024: Reddit’s Top Picks

- Best Online Businesses To Start In Australia: Your Guide To Success

- The Ultimate Guide To Starting A Profitable Online Business In Nigeria In 2024

- Best Online Trading Platforms In The UAE: Your Guide To Navigating The Market

- The Ultimate Guide To Starting A Thriving Online Business In Qatar

With great pleasure, we will explore the intriguing topic related to Small Business Depreciation: Your Guide to Tax Savings in 2024. Let’s weave interesting information and offer fresh perspectives to the readers.

Small Business Depreciation: Your Guide to Tax Savings in 2024

Let’s face it, running a small business is a rollercoaster ride. One minute you’re celebrating a successful launch, the next you’re grappling with rising costs and a seemingly endless to-do list. But there’s a secret weapon in your arsenal that can help you navigate the financial ups and downs: depreciation.

Think of depreciation as a tax-saving superhero that helps you recover the cost of your business assets over time. It’s like getting a little bit of money back each year for those essential tools and equipment that are the backbone of your operation.

Why Depreciation Matters for Small Businesses

Imagine this: You invest in a brand-new state-of-the-art computer system for your office. It’s a significant expense, but it’s crucial for your business to stay competitive and efficient. Now, the IRS understands that these assets wear down and lose value over time. That’s where depreciation comes in.

Depreciation allows you to deduct a portion of the asset’s cost each year, reducing your taxable income and ultimately lowering your tax bill. This means more cash flow for your business, which can be used to reinvest in growth, cover operating expenses, or even give you a little breathing room during tough times.

Understanding the Basics of Depreciation

Depreciation is like a gradual decline in value. Imagine a brand new car. As you drive it, it slowly loses its value due to wear and tear, mileage, and the passage of time. The same principle applies to business assets.

The IRS provides specific guidelines for how to calculate depreciation, and it’s based on the asset’s useful life. This useful life is an estimated period during which the asset is expected to be productive for your business. For example, a computer system might have a useful life of 5 years, while a building could have a useful life of 39 years.

Different Depreciation Methods: Finding the Right Fit for Your Business

There are several depreciation methods available, each with its own set of rules and benefits. Choosing the right method depends on your specific circumstances and the nature of your assets.

1. Straight-Line Depreciation

This is the simplest and most common method. It evenly distributes the cost of the asset over its useful life. Think of it as taking equal-sized bites out of a cake.

2. Accelerated Depreciation Methods

These methods allow you to take larger deductions in the early years of an asset’s life and smaller deductions later on. This can be beneficial for businesses that need to maximize their tax savings in the early stages of an asset’s use.

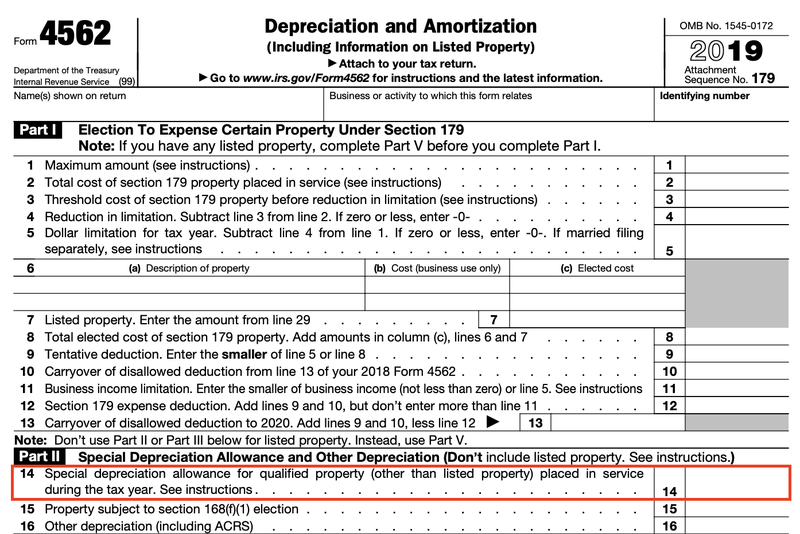

3. Section 179 Deduction

This special deduction allows you to deduct the full cost of certain qualifying assets in the year you purchase them. Think of it as a big tax break upfront.

Depreciation for Your Business: A Step-by-Step Guide

Here’s a simplified guide to help you navigate the world of depreciation:

- Identify Depreciable Assets: Start by identifying the assets in your business that qualify for depreciation. This includes things like computers, vehicles, furniture, equipment, and even buildings.

- Determine the Asset’s Useful Life: Research the IRS guidelines to find the estimated useful life for each asset.

- Choose a Depreciation Method: Select the depreciation method that best suits your business needs and the nature of your assets.

- Calculate Depreciation Expense: Use the chosen depreciation method to calculate the annual depreciation expense for each asset.

- Record Depreciation on Your Tax Return: Report your depreciation expense on your business tax return using the appropriate forms.

Depreciating Your Way to Success: Real-World Examples

Let’s bring depreciation to life with a couple of real-world examples:

Example 1: The New Delivery Van

Imagine you own a bakery and purchase a new delivery van for $30,000. The IRS assigns a useful life of 5 years for delivery vans. You choose the straight-line depreciation method.

Each year, you’ll deduct $6,000 ($30,000 / 5 years) in depreciation expense. This reduces your taxable income and lowers your tax bill.

Example 2: The Cutting-Edge Bakery Equipment

Let’s say you invest in a new high-tech oven for your bakery. It costs $20,000 and has a useful life of 7 years. You opt for the accelerated depreciation method, specifically the Modified Accelerated Cost Recovery System (MACRS).

This method allows you to take larger deductions in the early years, giving you a bigger tax benefit upfront.

Navigating the Depreciation Maze: Common Mistakes to Avoid

Depreciation can be a bit of a puzzle, and it’s easy to make mistakes. Here are some common pitfalls to watch out for:

1. Forgetting to Track Asset Costs

It’s crucial to keep detailed records of all your business assets, including purchase dates, costs, and any improvements or repairs. This information is essential for calculating depreciation accurately.

2. Using the Wrong Depreciation Method

Each depreciation method has specific rules and requirements. Choosing the wrong method can lead to errors on your tax return.

3. Failing to Adjust for Asset Disposals

If you sell or dispose of an asset before the end of its useful life, you need to adjust your depreciation calculations accordingly.

Depreciation: A Powerful Tool for Your Business Growth

Depreciation isn’t just about saving on taxes; it’s about maximizing your business potential. By strategically utilizing depreciation, you can free up cash flow for essential investments, expand your operations, and ultimately achieve greater financial stability.

Depreciation: Beyond the Basics

Here are some additional points to consider:

1. Depreciation and Business Valuation

Depreciation can also affect the valuation of your business. When you sell your business, the depreciated value of your assets will be reflected in the sale price.

2. Depreciation and Inventory

While depreciation applies to tangible assets like equipment, it doesn’t apply to inventory. Inventory is typically valued using the first-in, first-out (FIFO) or last-in, first-out (LIFO) methods.

3. Depreciation and Intangible Assets

Intangible assets, like trademarks and copyrights, can also be depreciated, but the process is more complex and subject to specific IRS regulations.

Conclusion

Depreciation might seem like a technical detail, but it’s a powerful tool that can significantly impact your small business’s financial health. By understanding the basics of depreciation, choosing the right method, and keeping meticulous records, you can unlock tax savings and fuel your business’s growth.

Remember, depreciation is a journey, not a destination. It’s an ongoing process that requires attention and strategic planning. By embracing depreciation, you’re not just saving money; you’re investing in your business’s future.

FAQs

1. What is the difference between depreciation and amortization?

Depreciation applies to tangible assets, like equipment and buildings, while amortization applies to intangible assets, like patents and copyrights.

2. Can I depreciate used assets?

Yes, you can depreciate used assets, but the depreciation period starts from the date you acquired them, not the date they were originally purchased.

3. Can I claim depreciation on assets I use for both business and personal purposes?

You can only claim depreciation on the portion of the asset used for business purposes. You’ll need to determine the percentage of business use and only depreciate that portion.

4. How do I know if I should use the straight-line or accelerated depreciation method?

The best method depends on your individual circumstances. Consider your business’s cash flow needs and the nature of the assets you’re depreciating.

5. What happens if I sell an asset before the end of its useful life?

You’ll need to adjust your depreciation calculations to account for the asset’s sale. The gain or loss on the sale will be reflected on your tax return.

Closure

Thus, we hope this article has provided valuable insights into Small Business Depreciation: Your Guide to Tax Savings in 2024. We thank you for taking the time to read this article. See you in our next article!