Unlocking the Power of Depreciation: A Simplified Guide for Small Businesses

Related Articles: Unlocking the Power of Depreciation: A Simplified Guide for Small Businesses

- Crafting The Perfect Online Business Bio For Instagram: A Guide To Building Your Brand

- What’s The Best Recipe For Online Business Success?

- The Ultimate Guide To Launching Your Online Business In The USA: From Idea To Income

- The Ultimate Guide To Launching Your Online Business In The UK: A Deep Dive Into The Best Opportunities

- Unlocking Growth: The Ultimate Guide To Choosing The Right Small Business Checking Account

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Power of Depreciation: A Simplified Guide for Small Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the Power of Depreciation: A Simplified Guide for Small Businesses

Are you a small business owner who’s feeling a little overwhelmed by the world of accounting? Don’t worry, you’re not alone! Many entrepreneurs find themselves lost in the jargon and complexities of financial statements. One particularly tricky concept that often causes confusion is depreciation.

But what if I told you that understanding depreciation isn’t just about accounting – it’s actually a powerful tool that can save you money and help you grow your business?

This guide will break down the basics of depreciation, explain why it’s important for small businesses, and provide you with practical tips for maximizing its benefits.

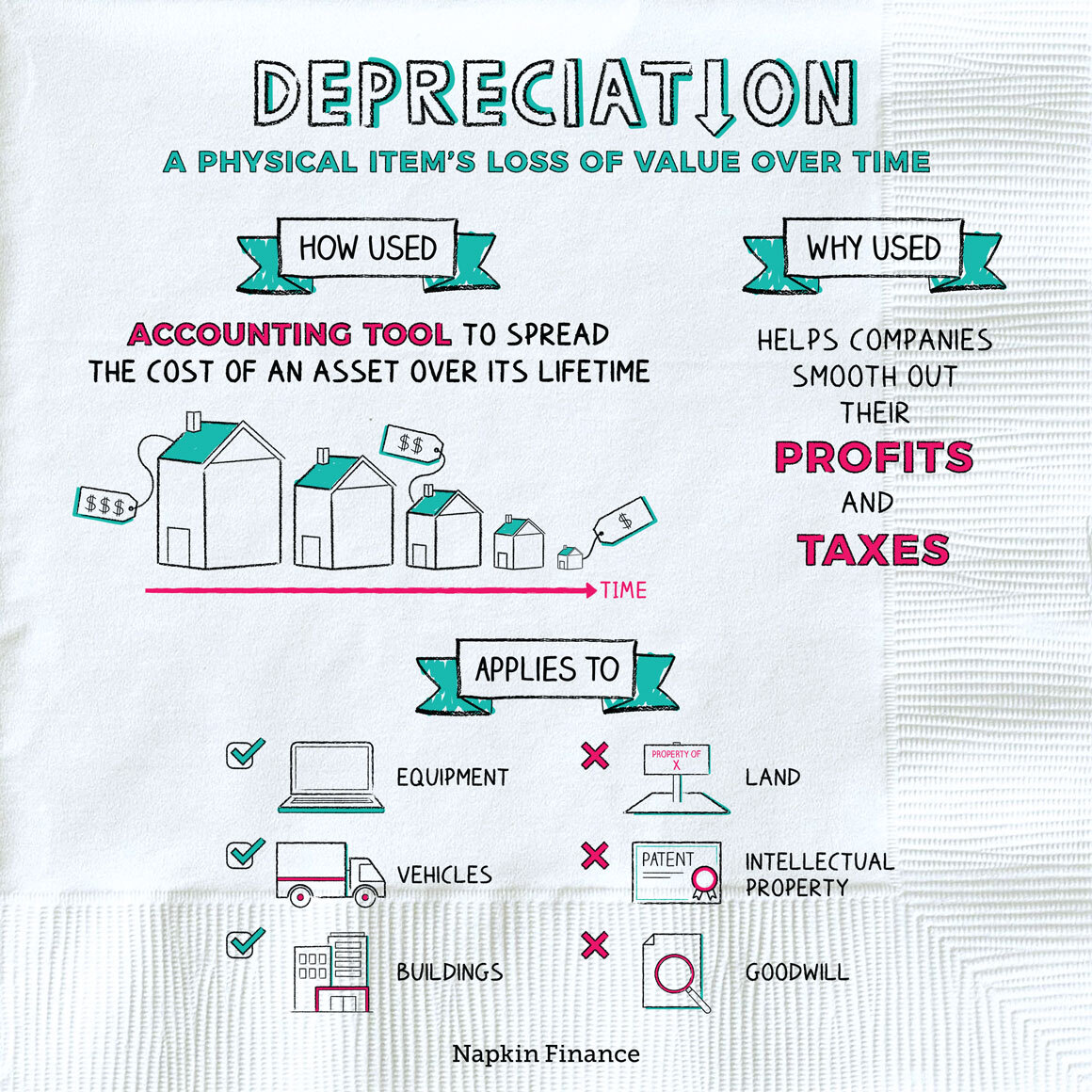

What is Depreciation?

Imagine you buy a brand-new, shiny delivery truck for your business. You’re excited about all the deliveries you’ll make, but you also know that truck won’t stay brand new forever. Over time, it will wear down, get used, and eventually need repairs or even replacement.

That’s where depreciation comes in. It’s essentially an accounting method that recognizes the decline in value of your assets over time. Think of it like spreading the cost of your truck over its useful life.

Why Does Depreciation Matter for Small Businesses?

Now, you might be thinking, "Why should I care about this accounting thing? I just want to run my business!" But here’s the thing: understanding depreciation can significantly impact your bottom line and your ability to make smart financial decisions.

- Tax Benefits: Depreciation allows you to deduct a portion of your asset’s cost each year on your taxes. This reduces your taxable income, leading to lower tax payments. Imagine having more money in your pocket at the end of the year – that’s the power of depreciation!

- Financial Planning: Depreciation helps you track the true cost of your assets over time. This information is crucial for making informed decisions about when to replace equipment, invest in new assets, or even take out loans.

- Accurate Financial Statements: Depreciation ensures that your financial statements accurately reflect the current value of your assets. This is important for lenders, investors, and even your own understanding of your business’s financial health.

Types of Depreciation Methods

There are several depreciation methods, each with its own formula and approach. Here are a few commonly used methods:

- Straight-Line Depreciation: This is the simplest method. It spreads the cost of an asset evenly over its useful life. Think of it like a steady decline in value.

- Double-Declining Balance: This method accelerates depreciation in the early years of an asset’s life, resulting in larger deductions in the beginning. It’s often used for assets that quickly lose value.

- Sum-of-the-Years’ Digits: This method also accelerates depreciation, but it’s a little more complex than the double-declining balance method.

Choosing the Right Depreciation Method

The best depreciation method for your business depends on several factors, including the type of asset, its useful life, and your tax strategy. It’s always best to consult with a tax professional to determine the most advantageous method for your specific situation.

Depreciation and Your Business’s Growth

Depreciation isn’t just about accounting; it can actually be a powerful tool for driving your business’s growth. Here’s how:

- Investing in New Assets: The tax savings from depreciation can free up cash flow for reinvesting in new equipment, technology, or expansion.

- Increased Profitability: By reducing your taxable income, depreciation can boost your profitability, allowing you to reinvest more into your business or even increase your own compensation.

- Improved Cash Flow: The tax deductions from depreciation can improve your cash flow, giving you more flexibility to manage your business operations and pursue new opportunities.

Practical Tips for Maximizing Depreciation

Now that you understand the benefits of depreciation, let’s explore some practical tips for maximizing its potential:

- Track Your Assets: Keep detailed records of all your business assets, including their purchase date, cost, and estimated useful life. This information is essential for calculating depreciation.

- Choose the Right Depreciation Method: As mentioned earlier, consult with a tax professional to determine the most beneficial depreciation method for your specific assets and circumstances.

- Take Advantage of Tax Incentives: Some tax incentives, like the bonus depreciation deduction, can accelerate depreciation and further reduce your tax burden. Stay informed about available incentives.

- Don’t Forget About Intangible Assets: Depreciation isn’t just for physical assets. You can also depreciate intangible assets like patents, trademarks, and copyrights.

Depreciation: A Powerful Tool for Small Business Success

Depreciation might seem like a complicated accounting concept, but it’s actually a valuable tool that can help you save money, boost your profitability, and drive your business’s growth. By understanding the basics of depreciation and using it strategically, you can position your small business for long-term success.

Conclusion

Depreciation is often seen as a dry accounting topic, but it’s actually a powerful tool that can significantly impact your business’s financial performance. By understanding the benefits of depreciation and using it strategically, you can unlock its potential to boost profitability, improve cash flow, and fuel your business’s growth.

Remember, depreciation is not just about accounting; it’s about making smart financial decisions that benefit your bottom line and contribute to your overall business success.

FAQs

1. What is the difference between depreciation and amortization?

Depreciation applies to tangible assets, like equipment and buildings, while amortization applies to intangible assets, like patents and copyrights.

2. How do I calculate depreciation?

The specific calculation depends on the depreciation method used. Consult with a tax professional or use online calculators to determine the depreciation expense for your assets.

3. Can I depreciate used assets?

Yes, you can depreciate used assets, but the depreciation period starts from the date you acquired them.

4. What happens if I sell an asset before its estimated useful life?

If you sell an asset before its estimated useful life, you may need to adjust the depreciation expense to reflect the actual period of use.

5. Is depreciation mandatory?

Depreciation is not mandatory for all businesses, but it’s often beneficial for tax purposes. It’s always best to consult with a tax professional to determine the best course of action for your specific situation.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Power of Depreciation: A Simplified Guide for Small Businesses. We appreciate your attention to our article. See you in our next article!