The Ultimate Guide to Small Business Funding: From Seed to Success

Related Articles: The Ultimate Guide to Small Business Funding: From Seed to Success

- The Ultimate Guide To Finding The Best Online Business DP For Girls: Level Up Your Brand!

- Unlock Your Entrepreneurial Spirit: The Best Online Businesses For Women In India

- Profitable Online Business Ideas 2024: A Guide to Success

- Finding Your Local Oasis: A Guide To Small Business Dispensaries Near You

- Unlock Your Entrepreneurial Dreams: The Ultimate Guide To Online Business Registration

With enthusiasm, let’s navigate through the intriguing topic related to The Ultimate Guide to Small Business Funding: From Seed to Success. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to Small Business Funding: From Seed to Success

Starting a small business is an exhilarating journey, filled with dreams, passion, and the unwavering belief that your idea can change the world. But let’s be real, the road to success is paved with challenges, and one of the biggest hurdles you’ll face is securing the financial resources to get your business off the ground.

Don’t worry, you’re not alone! This guide will equip you with the knowledge and strategies to navigate the complex world of small business funding, helping you secure the capital you need to turn your vision into reality.

Understanding Your Funding Needs: The Foundation of Success

Before diving headfirst into the world of funding options, it’s crucial to understand your specific needs. What are your short-term and long-term goals? How much funding do you actually require to achieve them?

Imagine this: You’re building a house. You wouldn’t start laying bricks without first understanding the blueprint, right? Similarly, your business plan is your blueprint. It outlines your goals, target market, and financial projections, providing a clear roadmap for your funding journey.

The Power of a Well-Crafted Business Plan

A well-structured business plan is your ticket to attracting investors. It’s not just a document; it’s a compelling story that showcases your vision, market analysis, and financial projections. Think of it as a persuasive pitch that convinces potential funders to invest in your success.

Here’s what makes a winning business plan:

- Executive Summary: A concise overview that captures the essence of your business and its potential.

- Company Description: A detailed explanation of your business, its products or services, and its unique value proposition.

- Market Analysis: A thorough examination of your target market, including size, trends, and competition.

- Marketing and Sales Strategy: A clear roadmap for reaching your target audience and generating revenue.

- Management Team: A showcase of your team’s expertise and experience, demonstrating their ability to execute your vision.

- Financial Projections: Realistic financial forecasts, including income statements, balance sheets, and cash flow statements.

Unveiling the Funding Landscape: A Comprehensive Overview

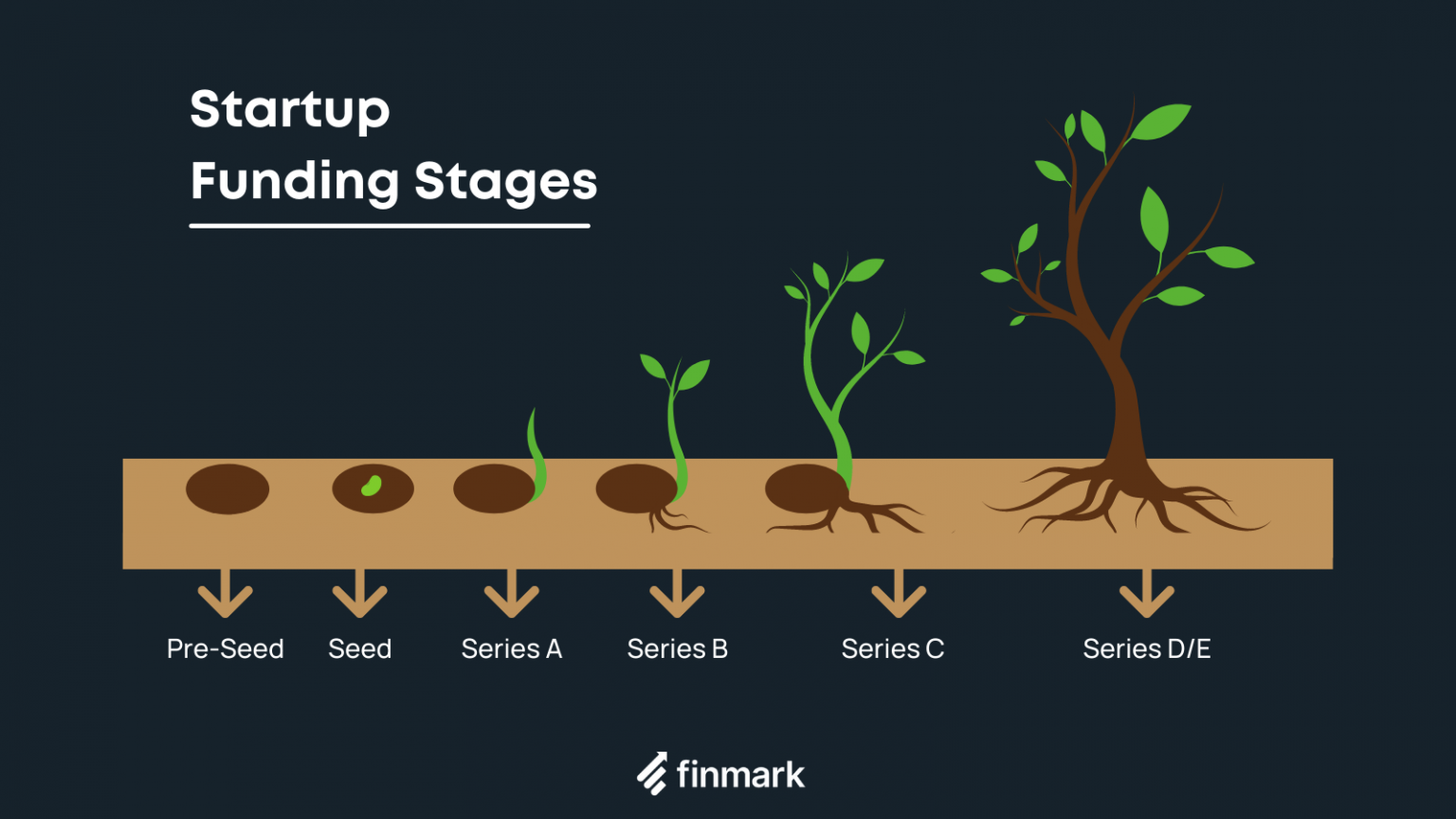

The world of small business funding is vast and diverse, offering a spectrum of options to suit different needs and stages of growth. Let’s explore the key funding sources available to you:

1. Bootstrapping: The Power of Self-Funding

Bootstrapping is the art of starting and growing your business with your own resources. It’s a lean approach that prioritizes resourcefulness, creativity, and a strong work ethic.

Here’s how you can bootstrap your business:

- Personal Savings: Utilize your own savings to fund your initial operations.

- Friends and Family: Tap into your network for loans or investments.

- Part-time Income: Generate income through a part-time job to supplement your business expenses.

- Bartering: Exchange goods or services for other goods or services to reduce costs.

2. Debt Financing: Leveraging Loans for Growth

Debt financing involves borrowing money from lenders, typically banks or credit unions, to finance your business operations. This option provides a structured framework for repayment, offering flexibility and potentially lower interest rates compared to other funding sources.

Common debt financing options include:

- Small Business Loans: Traditional bank loans designed specifically for small businesses.

- Line of Credit: A flexible borrowing option that allows you to access funds as needed.

- Equipment Financing: Loans specifically for purchasing equipment or machinery.

- SBA Loans: Loans guaranteed by the Small Business Administration (SBA), offering favorable terms and increased access to capital.

3. Equity Financing: Partnering for Growth

Equity financing involves selling a portion of your business ownership to investors in exchange for funding. This option can provide significant capital injections but comes with the caveat of sharing ownership and decision-making power.

Popular equity financing options include:

- Angel Investors: High-net-worth individuals who invest in early-stage companies with high growth potential.

- Venture Capitalists: Firms that invest in companies with the potential for significant returns.

- Crowdfunding: Utilizing online platforms to raise funds from a large number of individuals.

4. Grants: Funding for Innovation and Social Impact

Grants are non-repayable funds provided by government agencies, foundations, or other organizations to support specific initiatives or projects. They often target businesses focused on innovation, social impact, or community development.

Key types of grants include:

- Government Grants: Federal, state, and local government grants supporting various business sectors.

- Foundation Grants: Grants awarded by philanthropic organizations with specific funding priorities.

- Non-Profit Grants: Grants offered by non-profit organizations to support their mission.

Navigating the Funding Maze: Tips for Success

Securing funding for your small business can be a daunting task, but with the right approach and a strategic mindset, you can increase your chances of success.

1. Build a Compelling Story: Your Narrative is Key

Investors and lenders are drawn to compelling stories. Your business plan should not just present facts and figures; it should weave a narrative that captures their imagination and resonates with their values.

Here’s how to create a compelling narrative:

- Highlight your passion: Convey your genuine enthusiasm for your business and your unwavering belief in its success.

- Showcase your unique value proposition: Explain how your business solves a problem or fills a gap in the market.

- Emphasize your team’s expertise: Demonstrate the capabilities and experience of your team, highlighting their ability to execute your vision.

2. Network Your Way to Success: Building Relationships Matters

Networking is a powerful tool for securing funding. Attend industry events, connect with mentors, and leverage online platforms to expand your network and build relationships with potential investors and lenders.

Tips for effective networking:

- Be genuine and authentic: Build connections based on shared interests and mutual respect.

- Offer value: Provide insights, resources, or support to others within your network.

- Follow up consistently: Stay in touch with your contacts and nurture relationships over time.

3. Tailor Your Pitch: Understanding Your Audience

Every investor or lender has their own investment criteria and priorities. Before approaching any funding source, take the time to understand their specific interests and tailor your pitch accordingly.

Tips for tailoring your pitch:

- Research the investor or lender: Understand their investment history, portfolio, and areas of focus.

- Highlight relevant aspects of your business: Emphasize the features and benefits that align with their investment criteria.

- Practice your pitch: Rehearse your presentation and be prepared to answer questions effectively.

4. Embrace the Art of Negotiation: Finding Win-Win Solutions

Negotiation is an essential skill in securing funding. Be prepared to discuss terms, conditions, and equity stakes, ensuring a mutually beneficial agreement.

Tips for effective negotiation:

- Be confident and assertive: Express your needs and expectations clearly and professionally.

- Listen actively: Pay attention to the other party’s perspective and understand their concerns.

- Be flexible and creative: Explore alternative solutions that address both parties’ interests.

5. Be Persistent and Resilient: Never Give Up

The funding journey is not always smooth. You may face rejections, setbacks, and challenges along the way. But it’s crucial to remain persistent, learn from your experiences, and adapt your approach as needed.

Tips for staying persistent:

- Don’t take rejections personally: View them as opportunities for growth and improvement.

- Seek feedback and learn from your mistakes: Identify areas for improvement and refine your pitch.

- Stay focused on your goals: Remember your vision and the impact you want to make.

Common Funding Mistakes to Avoid

While securing funding can be a challenging process, there are certain mistakes that can significantly hinder your efforts. Here are some common pitfalls to avoid:

- Underestimating your funding needs: Don’t underestimate the costs of starting and running your business.

- Not having a solid business plan: A comprehensive business plan is essential for attracting investors and lenders.

- Ignoring your financial projections: Realistic financial forecasts are crucial for demonstrating the viability of your business.

- Failing to network and build relationships: Networking is essential for securing funding and accessing valuable resources.

- Not tailoring your pitch to your audience: Understand the specific interests of investors and lenders and tailor your pitch accordingly.

- Not being prepared to negotiate: Be prepared to discuss terms, conditions, and equity stakes.

- Giving up too easily: Persistence and resilience are essential in the funding journey.

Embracing the Funding Journey: From Seed to Success

Securing funding for your small business is a journey that requires patience, perseverance, and a strategic mindset. By understanding your funding needs, crafting a compelling business plan, exploring diverse funding options, and navigating the funding landscape with confidence, you can unlock the resources you need to turn your entrepreneurial dreams into reality. Remember, every successful business has a story to tell, and yours is just beginning.

Conclusion

The path to securing funding for your small business is not a straight line; it’s a winding road filled with twists and turns. But with the right knowledge, strategies, and unwavering determination, you can navigate the challenges and emerge with the resources you need to achieve your entrepreneurial goals.

Remember, funding is not just about securing capital; it’s about building relationships, forging partnerships, and creating a sustainable future for your business. Embrace the journey, learn from your experiences, and never give up on your dream.

FAQs

1. What are the best funding options for a startup with no prior revenue?

For startups with no prior revenue, bootstrapping, angel investors, and crowdfunding are often viable options. Bootstrapping allows you to start with your own resources, while angel investors and crowdfunding provide access to early-stage funding.

2. How can I improve my chances of securing a bank loan for my small business?

To increase your chances of securing a bank loan, ensure you have a strong business plan, a solid credit score, and a track record of financial management. Additionally, consider applying for an SBA loan, which offers favorable terms and increased access to capital.

3. What are some tips for negotiating with investors?

When negotiating with investors, be prepared to discuss terms, conditions, and equity stakes. Be confident and assertive, listen actively to their concerns, and be flexible in exploring alternative solutions.

4. How can I find potential investors for my business?

You can find potential investors through networking events, online platforms, and by leveraging your personal and professional network. Research investors in your industry and identify those who align with your business goals and values.

5. What are some resources available to help small businesses secure funding?

Several resources can assist small businesses in securing funding, including the Small Business Administration (SBA), SCORE, and local chambers of commerce. These organizations offer guidance, mentorship, and access to funding programs.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to Small Business Funding: From Seed to Success. We appreciate your attention to our article. See you in our next article!