QuickBooks: Your Guide to Streamlining Your Business Finances

Related Articles: QuickBooks: Your Guide to Streamlining Your Business Finances

- Unlocking Your Entrepreneurial Potential: The Ultimate Guide To The Best Online Businesses In 2023

- My Business: A Journey Of Growth, Lessons, And Dreams

- The Rise Of Online Business Banking: A Seamless Journey To Financial Freedom

- How To Get A Business License In Florida Online

- Start an Online Business From Home: A Step-by-Step Guide

In this auspicious occasion, we are delighted to delve into the intriguing topic related to QuickBooks: Your Guide to Streamlining Your Business Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

QuickBooks: Your Guide to Streamlining Your Business Finances

Introduction

Let’s face it, managing finances for a business can be a real headache. From tracking invoices to reconciling bank statements, the sheer volume of tasks can feel overwhelming. But what if I told you there’s a solution that could simplify all of this and give you back precious time to focus on what truly matters – growing your business?

That’s where QuickBooks comes in. It’s like having a personal financial assistant that handles all the nitty-gritty details, leaving you free to make strategic decisions. In this comprehensive guide, we’ll delve into the world of QuickBooks, exploring its features, benefits, and how it can revolutionize your business’s financial management.

What is QuickBooks?

QuickBooks is a powerful accounting software designed to help businesses of all sizes manage their finances effectively. It offers a range of features that cater to diverse needs, from tracking income and expenses to generating reports and managing inventory.

Why Choose QuickBooks?

Think of QuickBooks as your one-stop shop for all things financial. It simplifies complex tasks, automates repetitive processes, and provides real-time insights into your business’s performance.

H2: Unleashing the Power of QuickBooks: Key Features

H3: Accounting Made Easy

QuickBooks takes the guesswork out of accounting. With its intuitive interface and comprehensive features, you can effortlessly track your income, expenses, and inventory.

H3: Invoicing and Payments Simplified

Say goodbye to manual invoicing! QuickBooks allows you to create professional invoices, send them electronically, and receive payments securely. You can even track outstanding invoices and manage customer payments with ease.

H3: Bank Reconciliation Made Effortless

Bank reconciliation is a tedious process, but QuickBooks makes it a breeze. You can automatically import bank transactions and reconcile them with your accounting records, ensuring accuracy and reducing errors.

H3: Real-time Reporting

QuickBooks provides insightful reports that offer a clear picture of your business’s financial health. You can track key metrics, analyze trends, and make informed decisions based on real-time data.

H3: Inventory Management

For businesses that manage inventory, QuickBooks offers robust features for tracking stock levels, managing purchase orders, and optimizing inventory flow.

H4: Streamlining Your Operations

By automating tasks and providing real-time insights, QuickBooks allows you to streamline your operations, optimize your workflow, and ultimately, improve efficiency.

H2: QuickBooks: A Solution for Every Business

QuickBooks is designed to cater to the unique needs of different businesses. From solopreneurs to large enterprises, there’s a QuickBooks solution for everyone.

H3: QuickBooks Self-Employed

Perfect for freelancers and solopreneurs, QuickBooks Self-Employed simplifies tax preparation and expense tracking.

H3: QuickBooks Online

This cloud-based solution offers flexibility and accessibility, allowing you to manage your finances from anywhere with an internet connection.

H3: QuickBooks Desktop

Ideal for businesses that prefer a more traditional approach, QuickBooks Desktop provides a comprehensive suite of features for managing all aspects of your finances.

H2: The Benefits of Using QuickBooks

H3: Increased Efficiency

By automating tasks and streamlining processes, QuickBooks frees up your time so you can focus on other aspects of your business.

H3: Improved Accuracy

QuickBooks’s automated features and real-time data updates help to reduce errors and ensure accurate financial records.

H3: Better Decision-Making

With access to real-time financial data and insightful reports, you can make informed decisions about your business.

H3: Enhanced Financial Control

QuickBooks provides a centralized platform for managing all your finances, giving you complete control over your financial health.

H2: Real-Life Examples

H3: The Solopreneur:

Meet Sarah, a freelance graphic designer who was struggling to keep track of her income and expenses. She was spending hours manually entering data and felt overwhelmed by the task. After switching to QuickBooks Self-Employed, Sarah was able to automate her expense tracking and generate reports with ease. She now has a clear picture of her financial situation and can confidently make decisions about her business.

H3: The Small Business Owner:

John, the owner of a local bakery, was constantly juggling invoices, inventory, and bank reconciliations. He felt like he was drowning in paperwork. By implementing QuickBooks Online, John was able to streamline his operations, manage his inventory efficiently, and generate reports that helped him identify areas for improvement. His business is now more organized and profitable than ever.

H2: Addressing Concerns and Counterarguments

H3: Cost of QuickBooks

While QuickBooks offers a free trial, it’s important to consider the cost of using the software. However, the benefits of using QuickBooks often outweigh the cost, as it can save you time and money in the long run.

H3: Learning Curve

Some users may find the initial learning curve of QuickBooks challenging. However, QuickBooks offers extensive resources, including tutorials, support articles, and online courses, to help you get started.

H2: Tips for Maximizing QuickBooks

H3: Set Up Your Chart of Accounts

A well-organized chart of accounts is crucial for accurate financial reporting. Take the time to create a comprehensive chart of accounts that reflects your business’s specific needs.

H3: Reconcile Your Bank Accounts Regularly

Regularly reconciling your bank accounts ensures that your accounting records are accurate and up-to-date.

H4: Use QuickBooks’s Reporting Features

Take advantage of QuickBooks’s reporting features to gain insights into your business’s financial performance.

H4: Stay Updated

QuickBooks is constantly being updated with new features and improvements. Make sure you stay updated to take advantage of the latest advancements.

H2: The Future of QuickBooks

QuickBooks is constantly evolving to meet the changing needs of businesses. With the rise of artificial intelligence and cloud computing, we can expect to see even more innovative features and functionalities in the future.

H2: Conclusion

QuickBooks is an invaluable tool for businesses of all sizes. It streamlines financial management, improves efficiency, and empowers you to make informed decisions. By embracing QuickBooks, you can free yourself from the complexities of accounting and focus on what truly matters – growing your business.

FAQs

1. Is QuickBooks right for my business?

QuickBooks offers a range of solutions for different businesses, from solopreneurs to large enterprises. The best way to determine if QuickBooks is right for you is to assess your specific needs and budget.

2. How much does QuickBooks cost?

The cost of QuickBooks varies depending on the plan you choose. QuickBooks offers a free trial, so you can try it out before committing to a subscription.

3. Is QuickBooks easy to use?

QuickBooks has a user-friendly interface and provides extensive resources to help you get started. However, there may be a learning curve depending on your experience with accounting software.

4. Can I access QuickBooks from anywhere?

QuickBooks Online allows you to access your financial data from anywhere with an internet connection. QuickBooks Desktop requires you to use a computer.

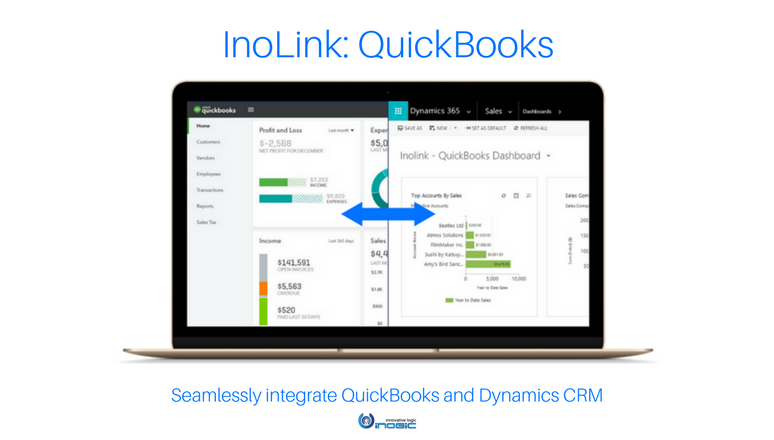

5. Does QuickBooks integrate with other software?

Yes, QuickBooks integrates with a variety of third-party software, including e-commerce platforms, payment processors, and CRM systems.

Closure

Thus, we hope this article has provided valuable insights into QuickBooks: Your Guide to Streamlining Your Business Finances. We thank you for taking the time to read this article. See you in our next article!