The Ultimate Guide to Best Online Business Accounts in the UK: Finding the Perfect Fit for Your Needs

Related Articles: The Ultimate Guide to Best Online Business Accounts in the UK: Finding the Perfect Fit for Your Needs

- The Power Of A Business Management Degree: Unlocking Your Career Potential

- Sharpen Your Business Acumen: How Online Courses Can Supercharge Your Success

- The Ultimate Guide To Small Business Success: From Idea To Empire

- The Ultimate Guide To Finding The Best Online Business Account: A Deep Dive Into The World Of Business Banking

- The Ultimate Guide To Choosing The Best Online Business Checking Account

With enthusiasm, let’s navigate through the intriguing topic related to The Ultimate Guide to Best Online Business Accounts in the UK: Finding the Perfect Fit for Your Needs. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to Best Online Business Accounts in the UK: Finding the Perfect Fit for Your Needs

Starting a business is exciting, but navigating the financial landscape can feel overwhelming. Choosing the right online business account is crucial for smooth operations, efficient money management, and ultimately, success. With so many options available, it’s easy to get lost in a sea of features, fees, and jargon.

This comprehensive guide will equip you with the knowledge and tools to find the best online business account for your specific needs. We’ll delve into the key factors to consider, explore different account types, and uncover hidden gems that might surprise you.

Let’s dive in!

Why You Need a Dedicated Business Account

Imagine trying to manage your personal and business finances in the same pot – a recipe for disaster, right? A dedicated business account provides the structure and clarity you need to thrive. Here’s why it’s a game-changer:

- Clear Financial Separation: Track your business income and expenses effortlessly, avoiding confusion and potential legal headaches.

- Improved Business Credit: Building a strong credit history with your business account unlocks future opportunities for loans, financing, and partnerships.

- Professional Image: A separate business account projects professionalism and credibility, inspiring trust in clients and investors.

- Simplified Tax Filing: Categorizing transactions becomes a breeze, making tax season a less stressful experience.

The Key Factors to Consider When Choosing an Online Business Account

Not all online business accounts are created equal. To make the right decision, consider these crucial factors:

1. Account Fees:

- Monthly Fees: Some banks charge a monthly fee for maintaining a business account.

- Transaction Fees: Be aware of charges for transactions like deposits, withdrawals, and payments.

- Overdraft Fees: These can add up quickly, so understand the bank’s overdraft policies.

- International Transaction Fees: If you’re involved in global trade, consider the cost of international transfers.

2. Account Features:

- Online and Mobile Banking: Seamless access to your account anytime, anywhere, is essential for modern businesses.

- Payment Processing: Does the account offer integrated payment gateways like PayPal, Stripe, or Worldpay?

- Invoice Generation and Management: Streamline invoicing and track payments with dedicated features.

- Reporting and Analytics: Gain insights into your business performance with detailed reports and analytics tools.

3. Customer Support:

- Availability: How readily can you reach customer support? Are they available 24/7?

- Response Time: How quickly do they address your queries?

- Channels: What communication channels are available (phone, email, live chat)?

4. Bank Reputation and Security:

- Financial Stability: Choose a bank with a solid reputation and strong financial standing.

- Security Measures: Ensure the bank employs robust security protocols to protect your financial data.

- Data Privacy: Understand the bank’s data privacy policies and how they safeguard your information.

Unveiling the Best Online Business Accounts in the UK: A Detailed Comparison

Now, let’s dive into the specifics, examining some of the top contenders for online business accounts in the UK:

1. Monzo:

Ideal for: Startups and small businesses seeking simplicity and mobile-first banking.

Key Features:

- Free Business Account: No monthly fees, making it budget-friendly.

- Seamless Mobile App: Manage your finances on the go with user-friendly features.

- Instant Payments: Send and receive payments quickly with the Monzo app.

- Business Debit Card: Track your business expenses easily with a dedicated card.

Pros:

- User-friendly mobile app: Perfect for tech-savvy entrepreneurs.

- Free account: Attractive for startups and small businesses on a tight budget.

- Instant payments: Streamline your financial transactions.

Cons:

- Limited features: May not suit businesses with complex financial needs.

- No dedicated customer support: Reliance on online resources and community forums.

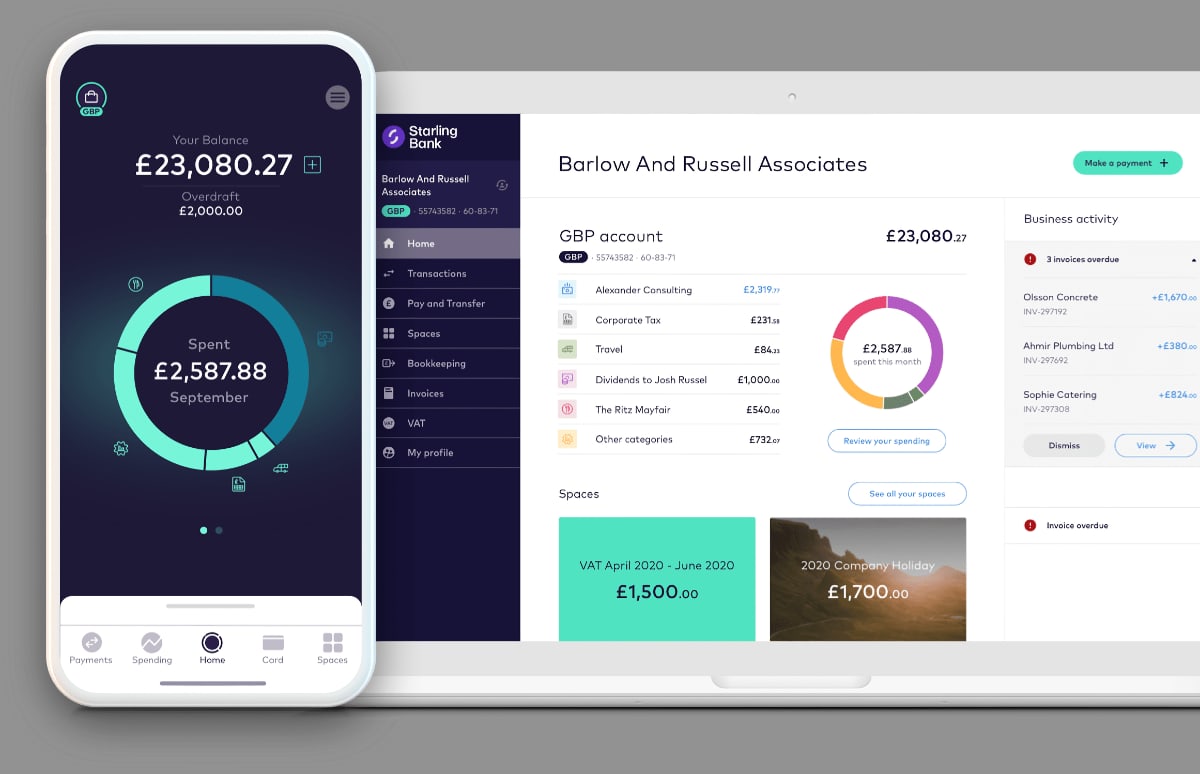

2. Starling Bank:

Ideal for: Businesses looking for a comprehensive suite of features and excellent customer support.

Key Features:

- Free Business Account: No monthly fees for basic accounts.

- Business Debit Card: Track your business expenses with ease.

- Invoice Generation and Management: Streamline invoicing and track payments.

- Dedicated Customer Support: Access to phone and email support.

Pros:

- Comprehensive features: Covers most business needs, from payments to invoicing.

- Excellent customer support: Provides reliable assistance when you need it.

- Free account: Appealing for businesses seeking cost-effective solutions.

Cons:

- Limited international payment options: May not be suitable for businesses with global operations.

- Higher fees for advanced features: Consider the cost of additional services like payment processing.

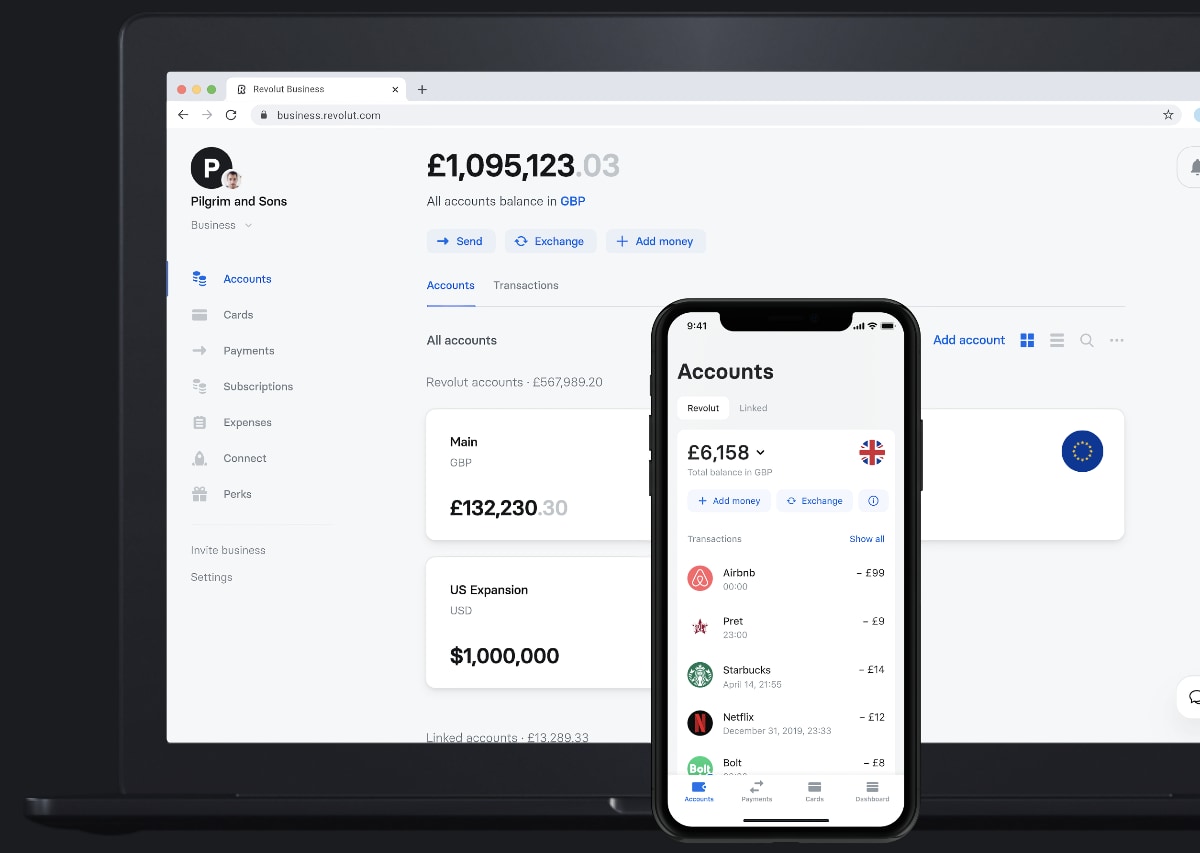

3. Revolut Business:

Ideal for: Businesses with international operations and a need for multi-currency accounts.

Key Features:

- Multi-Currency Accounts: Manage funds in multiple currencies with ease.

- International Transfers: Send and receive money globally with competitive rates.

- Expense Management: Track your business expenses with detailed reports.

- Virtual Cards: Generate virtual cards for online purchases and subscriptions.

Pros:

- Multi-currency support: Ideal for businesses with international transactions.

- Competitive exchange rates: Save money on international transfers.

- Advanced expense management: Gain insights into your spending patterns.

Cons:

- Monthly fees: May not be budget-friendly for all businesses.

- Limited banking features: May not provide all the features you need for a full-fledged business account.

4. Tide:

Ideal for: Freelancers and sole traders seeking a simple and affordable solution.

Key Features:

- Low Monthly Fees: Affordable option for solopreneurs and small businesses.

- Business Debit Card: Track your expenses with ease.

- Invoice Generation: Create and send invoices directly from the app.

- Mobile App: Manage your finances on the go.

Pros:

- Low cost: Attractive for freelancers and solopreneurs.

- Simple and user-friendly: Easy to navigate and manage.

- Dedicated app: Provides a streamlined mobile banking experience.

Cons:

- Limited features: May not suit businesses with complex financial needs.

- Limited customer support: Reliance on online resources and FAQs.

5. Metro Bank:

Ideal for: Businesses seeking a traditional banking experience with a personal touch.

Key Features:

- Business Current Account: Offers a range of account options to suit different business needs.

- Dedicated Account Manager: Provides personalized support and guidance.

- Branch Network: Access to a network of physical branches for in-person banking.

- Business Loans and Overdrafts: Access to financing options for business growth.

Pros:

- Traditional banking experience: Offers a familiar and reliable service.

- Dedicated account manager: Provides personalized support and advice.

- Branch network: Provides flexibility for in-person banking.

Cons:

- Higher fees: May not be budget-friendly for all businesses.

- Limited online and mobile banking features: May not be as convenient for tech-savvy entrepreneurs.

Tips for Choosing the Right Online Business Account

With so many options available, it’s essential to approach your decision strategically. Here are some tips to help you find the perfect fit:

- Assess your business needs: What are your core financial requirements? Do you need multi-currency accounts, advanced payment processing, or robust reporting features?

- Compare features and fees: Don’t just focus on the headline price. Consider the overall cost of ownership, including transaction fees, overdraft charges, and the cost of additional services.

- Read reviews and testimonials: Get insights from other business owners about their experiences with different banks.

- Consider your long-term goals: Will your business needs evolve over time? Choose a bank that can grow with you.

- Don’t be afraid to switch: If you’re not satisfied with your current account, don’t hesitate to switch to a better option.

Navigating the World of Business Account Jargon

Navigating the world of business accounts can be confusing, with a plethora of terms and jargon. Here’s a quick glossary to help you decipher the language:

- Current Account: A standard business account for everyday transactions.

- Business Debit Card: A card for making business purchases and withdrawals.

- Payment Gateway: A service that processes online payments for your business.

- Invoice Generation: The ability to create and send invoices to clients.

- Reporting and Analytics: Tools that provide insights into your business finances.

- Overdraft: The ability to withdraw more money than you have in your account, subject to fees.

- Transaction Fees: Charges for making deposits, withdrawals, and payments.

- Monthly Fees: A recurring charge for maintaining a business account.

- International Transaction Fees: Charges for making transfers to accounts outside the UK.

Real-Life Examples: How Different Businesses Choose Their Accounts

- The Startup: A new tech company with limited funds might opt for a free business account from Monzo or Starling Bank, prioritizing affordability and mobile-first features.

- The E-commerce Store: An online retailer with international customers might choose Revolut Business for its multi-currency accounts and competitive exchange rates.

- The Freelancer: A solopreneur might find Tide’s low monthly fees and simple interface ideal for managing their finances.

- The Established Business: A well-established company with complex financial needs might opt for a business current account from Metro Bank, benefiting from dedicated account managers and a branch network.

Addressing Potential Counterarguments

Some might argue that traditional banks offer more personalized service and a wider range of products. While this might be true, online business accounts are rapidly catching up, offering competitive features, lower fees, and enhanced convenience.

Others might claim that online banks lack the security of traditional institutions. However, reputable online banks employ robust security measures, including encryption and multi-factor authentication, to protect your financial data.

Conclusion

Choosing the best online business account is a crucial decision that can impact your business’s success. By understanding your needs, comparing features and fees, and considering long-term goals, you can find the perfect fit. Remember, the right account will streamline your finances, enhance your productivity, and empower you to focus on what matters most: growing your business.

FAQs:

- What are the best online business accounts for startups? Monzo and Starling Bank offer free business accounts with user-friendly mobile apps and essential features, making them ideal for startups.

- Do I need a separate business account if I’m a sole trader? Yes, having a dedicated business account is crucial for separating your personal and business finances, improving your business credit, and simplifying tax filing.

- What are the benefits of an online business account? Online business accounts offer convenience, accessibility, competitive fees, and often include advanced features like payment processing, invoicing, and reporting tools.

- How do I choose the best online business account for my business? Assess your business needs, compare features and fees, read reviews, consider your long-term goals, and don’t be afraid to switch if you’re not satisfied.

- What are some common business account jargon terms? Familiarize yourself with terms like current account, business debit card, payment gateway, invoice generation, reporting and analytics, overdraft, transaction fees, monthly fees, and international transaction fees.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to Best Online Business Accounts in the UK: Finding the Perfect Fit for Your Needs. We thank you for taking the time to read this article. See you in our next article!