Finding the Right Fit: Your Guide to the Best Online Business Accounting Software

Related Articles: Finding the Right Fit: Your Guide to the Best Online Business Accounting Software

- The Ultimate Guide To Online Jobs: From Side Hustle To Full-Time Freedom

- Elevate Your Home: A Guide To Luxury Home Decor

- Navigating The Legal Labyrinth: A Guide To Choosing The Right Law Firm

- Unlock Your Inner Entrepreneur: The Ultimate Guide To Starting An Online Business With Zero Investment

- Online Business Ideas Without Investment 2024: Launch Your Dream

With great pleasure, we will explore the intriguing topic related to Finding the Right Fit: Your Guide to the Best Online Business Accounting Software. Let’s weave interesting information and offer fresh perspectives to the readers.

Finding the Right Fit: Your Guide to the Best Online Business Accounting Software

Let’s face it, managing finances can feel like navigating a labyrinth of spreadsheets, receipts, and bank statements. But what if I told you there’s a way to streamline your business finances, making it easier to track your income and expenses, generate reports, and even predict future financial performance? Enter the world of online accounting software.

These powerful tools are designed to take the headache out of accounting, offering a range of features that can help you manage your business finances more effectively. But with so many options available, how do you choose the best online accounting software for your needs?

This guide will walk you through the key factors to consider, highlight some of the top contenders, and ultimately help you find the perfect fit for your business.

Why Online Accounting Software is a Game Changer

Remember those days of juggling multiple spreadsheets, manually reconciling bank statements, and spending hours trying to decipher your financial data? Online accounting software aims to banish those memories.

Here’s why it’s a game-changer for businesses of all sizes:

1. Streamlined Financial Management:

Online accounting software centralizes all your financial data in one place, providing a clear and comprehensive view of your business’s financial health. Imagine having all your invoices, expenses, bank transactions, and reports readily available at your fingertips. No more scattered files or lost receipts!

2. Automated Processes:

Say goodbye to tedious manual tasks. Online accounting software automates many repetitive processes like bank reconciliation, invoice generation, and expense tracking. This frees up your time to focus on strategic tasks like growing your business.

3. Real-Time Insights:

With online accounting software, you can access real-time insights into your business finances. This means you can track your cash flow, identify trends, and make informed decisions based on up-to-date information. No more waiting for month-end reports!

4. Improved Accuracy:

Online accounting software minimizes human error by automating tasks and providing built-in checks and balances. This ensures that your financial data is accurate and reliable, giving you confidence in your financial decisions.

5. Collaboration Made Easy:

Many online accounting software solutions offer collaboration features, allowing you to share financial data with your team, accountant, or financial advisor. This fosters transparency and improves communication, making it easier to manage your finances together.

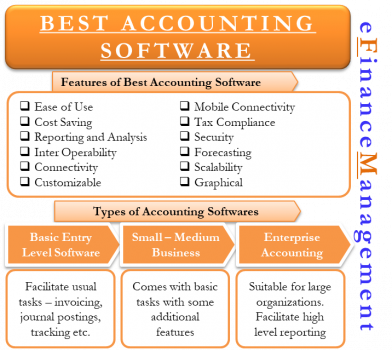

Key Features to Look for in Online Accounting Software

Choosing the right online accounting software is like selecting the perfect tool for a specific job. You need to consider your business needs and prioritize the features that will make the biggest difference.

Here are some key features to look for:

1. Bank Reconciliation:

This feature automatically matches bank transactions with your accounting records, saving you countless hours of manual reconciliation. Look for software that offers seamless integration with your bank accounts.

2. Invoice Generation and Management:

Efficient invoice generation and management are crucial for any business. Choose software that allows you to create professional invoices, track payments, and send reminders.

3. Expense Tracking:

Track your business expenses with ease. Look for software that allows you to categorize expenses, upload receipts, and generate reports. Some even offer mobile apps for on-the-go expense tracking.

4. Reporting and Analytics:

Online accounting software provides valuable insights into your financial performance. Look for features that allow you to generate customizable reports, track key metrics, and analyze trends.

5. Inventory Management:

If you sell products, inventory management is essential. Choose software that allows you to track inventory levels, manage stock orders, and generate reports on inventory performance.

6. Payroll Management:

Some online accounting software solutions offer payroll management features. This can be a huge time-saver, especially for businesses with employees. Look for software that integrates with payroll providers and handles tax calculations.

7. Tax Compliance:

Online accounting software can help you stay compliant with tax regulations. Look for features that automate tax calculations, generate tax reports, and integrate with tax filing services.

8. Mobile Accessibility:

Access your financial data anytime, anywhere with a mobile app. Look for software that offers a user-friendly mobile interface and allows you to manage your finances on the go.

9. Customer Support:

Choose software with reliable customer support. You want to be able to get help quickly and easily when you need it.

10. Security:

Your financial data is sensitive, so choose software that prioritizes security. Look for features like data encryption, two-factor authentication, and regular security updates.

Top Online Accounting Software Options

Now that you know what to look for, let’s explore some of the top online accounting software options available today.

1. Xero:

Xero is a popular choice for small businesses, known for its user-friendly interface, powerful features, and excellent customer support. It offers a comprehensive suite of accounting tools, including invoicing, expense tracking, bank reconciliation, and reporting. Xero also integrates with a wide range of third-party apps, making it a versatile solution for businesses of all kinds.

2. QuickBooks Online:

QuickBooks Online is another industry leader, offering a range of plans to suit different business needs. It’s known for its robust accounting features, including inventory management, payroll, and tax compliance. QuickBooks Online also offers excellent mobile accessibility, making it easy to manage your finances on the go.

3. FreshBooks:

FreshBooks is a popular choice for freelancers and small businesses, known for its intuitive design and focus on invoicing. It offers a simple and efficient way to create professional invoices, track payments, and manage expenses. FreshBooks also integrates with popular payment gateways, making it easy to accept online payments.

4. Zoho Books:

Zoho Books is a comprehensive accounting solution that offers a wide range of features, including invoicing, expense tracking, bank reconciliation, and reporting. It’s known for its affordability and its integration with other Zoho apps, making it a good choice for businesses that use other Zoho products.

5. Wave Accounting:

Wave Accounting is a free option for small businesses, offering basic accounting features like invoicing, expense tracking, and bank reconciliation. It’s a good starting point for businesses that are just getting started or have limited budgets.

Choosing the Right Software for Your Business

With so many options available, choosing the right online accounting software can feel overwhelming. Here are some factors to consider:

1. Business Size:

If you’re a small business with basic needs, you might find a simple solution like FreshBooks or Wave Accounting sufficient. Larger businesses with more complex needs might require a more robust solution like Xero or QuickBooks Online.

2. Industry:

Certain industries have specific accounting needs. For example, businesses in the retail industry may need inventory management features, while service-based businesses may prioritize invoicing and expense tracking.

3. Budget:

Online accounting software comes in a range of price points. Consider your budget and choose a solution that offers the features you need at a price you can afford.

4. Features:

Prioritize the features that are most important to your business. Do you need inventory management, payroll, or tax compliance features? Make sure the software you choose offers the features you need.

5. Ease of Use:

Choose software that is easy to learn and use. You want a solution that will save you time and effort, not add to your workload.

6. Customer Support:

Look for software with reliable customer support. You want to be able to get help quickly and easily when you need it.

Tips for Getting the Most Out of Online Accounting Software

Once you’ve chosen the right online accounting software, here are some tips for getting the most out of it:

1. Set Up Your Accounts:

Take the time to set up your accounts correctly. This includes creating your chart of accounts, adding your bank accounts, and setting up your payment methods.

2. Automate Your Processes:

Take advantage of the automation features offered by your software. Automate tasks like bank reconciliation, invoice generation, and expense tracking.

3. Track Your Expenses Regularly:

Enter your expenses regularly to maintain accurate financial records. Use the software’s mobile app to track expenses on the go.

4. Reconcile Your Bank Accounts:

Reconcile your bank accounts regularly to ensure that your accounting records are accurate. Most online accounting software offers automated bank reconciliation features.

5. Generate Reports:

Use the software’s reporting features to generate insights into your financial performance. Track key metrics like revenue, expenses, and profit.

6. Stay Up-to-Date:

Keep your software up-to-date with the latest updates and features. This will ensure that you have access to the most current functionality and security patches.

Conclusion

Online accounting software is a powerful tool that can help you manage your business finances more effectively. By choosing the right software and using it effectively, you can streamline your accounting processes, improve your financial accuracy, and gain valuable insights into your business performance.

Don’t let accounting be a burden. Embrace the power of online accounting software and take control of your business finances today.

FAQs

1. What are the best online accounting software options for small businesses?

There are many great options for small businesses, including Xero, QuickBooks Online, FreshBooks, and Wave Accounting. The best choice for you will depend on your specific needs and budget.

2. How much does online accounting software cost?

The cost of online accounting software varies depending on the features and plans offered. Some solutions offer free plans for basic features, while others offer paid plans with more advanced features.

3. Is online accounting software secure?

Reputable online accounting software providers prioritize security and use advanced measures like data encryption, two-factor authentication, and regular security updates to protect your financial data.

4. Can I use online accounting software if I don’t have any accounting experience?

Yes, most online accounting software solutions are designed to be user-friendly and intuitive, even for those with limited accounting experience. Many offer helpful tutorials and support resources to guide you through the process.

5. How can I find the right online accounting software for my business?

Consider your business needs, budget, and the features you require. Research different options, read reviews, and try out free trials before making a decision.

Closure

Thus, we hope this article has provided valuable insights into Finding the Right Fit: Your Guide to the Best Online Business Accounting Software. We hope you find this article informative and beneficial. See you in our next article!