The Ultimate Guide to Best Online Gold Trading Platforms: A Comprehensive Review

Related Articles: The Ultimate Guide to Best Online Gold Trading Platforms: A Comprehensive Review

- The Ultimate Guide To Top Online Graduate Business Schools: Your Path To Success

- Enhance Your Career With Me: Pursue An Online Bachelor Of Business Management For Success

- The Ultimate Guide To Business Insurance: Protecting Your Dreams From The Unexpected

- Easy Online Business Ideas 2024: Your Path to Success

- The Ultimate Guide To The Best Online Businesses For 2024: Unlock Your Entrepreneurial Dreams

With enthusiasm, let’s navigate through the intriguing topic related to The Ultimate Guide to Best Online Gold Trading Platforms: A Comprehensive Review. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to Best Online Gold Trading Platforms: A Comprehensive Review

Have you ever considered diversifying your investment portfolio with gold? The allure of this precious metal is undeniable, offering a haven during economic uncertainty and a potential hedge against inflation. But navigating the world of gold trading can feel overwhelming, especially for beginners.

This comprehensive guide will equip you with the knowledge and insights needed to choose the best online gold trading platform for your needs. From understanding the basics of gold trading to comparing top platforms, we’ll cover everything you need to confidently enter the world of gold investment.

Understanding the Basics of Gold Trading

Before diving into the best platforms, let’s clarify the fundamentals of gold trading.

What is Gold Trading?

Gold trading involves buying and selling gold contracts or physical gold through various channels. These channels can range from traditional exchanges to online platforms, each offering distinct advantages and disadvantages.

Why Trade Gold?

Gold’s appeal as an investment stems from its unique properties:

- Safe Haven: Gold is perceived as a safe haven asset, often rising in value during economic turmoil or geopolitical uncertainty.

- Inflation Hedge: Gold’s price tends to rise with inflation, preserving purchasing power.

- Portfolio Diversification: Adding gold to your portfolio can reduce overall risk and improve returns.

Types of Gold Trading

There are various ways to trade gold:

- Spot Gold: Trading gold at the current market price.

- Futures Contracts: Contracts to buy or sell gold at a specific price and date in the future.

- Exchange-Traded Funds (ETFs): Funds that track the price of gold, offering a convenient way to invest in the metal.

- Physical Gold: Investing in physical gold bars or coins, providing direct ownership.

Key Factors to Consider When Choosing a Gold Trading Platform

Now that you have a basic understanding of gold trading, let’s delve into the key factors to consider when selecting an online platform:

1. Regulation and Security

- Regulatory Oversight: Ensure the platform is regulated by reputable authorities like the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC). This provides investor protection and ensures fair market practices.

- Security Measures: Look for platforms with robust security features like two-factor authentication, encryption, and secure data storage.

2. Trading Fees and Commissions

- Trading Fees: These can vary significantly between platforms, so compare fees for different trade types, including spot gold, futures, and ETFs.

- Commissions: Some platforms may charge commissions on top of trading fees.

- Account Minimums: Some platforms have minimum account balances required to start trading.

3. Trading Instruments and Products

- Gold Contracts: Ensure the platform offers the specific gold instruments you want to trade, such as spot gold, futures, or ETFs.

- Other Asset Classes: Some platforms offer trading in other asset classes, like currencies or stocks, allowing you to diversify your portfolio.

4. Trading Platform and User Interface

- User Interface: The platform should be user-friendly, with intuitive navigation and easy-to-understand features.

- Mobile App: Consider platforms with a mobile app, allowing you to trade on the go.

- Research and Analysis Tools: Look for platforms with tools that provide market data, charts, and analysis to support your trading decisions.

5. Customer Support and Education

- Customer Support: Ensure the platform offers reliable and responsive customer support, available through various channels like phone, email, and chat.

- Educational Resources: Look for platforms that provide educational materials, tutorials, and webinars to help you learn about gold trading.

Top Online Gold Trading Platforms: A Comparative Analysis

Now, let’s examine some of the top online gold trading platforms, comparing their features and suitability for different types of investors:

1. [Platform Name]

- Pros: [List platform’s strengths, including low fees, user-friendly interface, advanced trading tools, etc.]

- Cons: [List platform’s weaknesses, such as limited product offerings, high account minimums, or lack of educational resources.]

- Suitable for: [Describe the investor type best suited for this platform, e.g., beginners, experienced traders, etc.]

2. [Platform Name]

- Pros: [List platform’s strengths, including robust security features, excellent customer support, etc.]

- Cons: [List platform’s weaknesses, such as high trading fees, limited research tools, etc.]

- Suitable for: [Describe the investor type best suited for this platform, e.g., risk-averse investors, those seeking long-term investments, etc.]

3. [Platform Name]

- Pros: [List platform’s strengths, including wide range of trading instruments, comprehensive educational resources, etc.]

- Cons: [List platform’s weaknesses, such as complex platform interface, high account minimums, etc.]

- Suitable for: [Describe the investor type best suited for this platform, e.g., experienced traders, those seeking advanced trading features, etc.]

4. [Platform Name]

- Pros: [List platform’s strengths, including competitive pricing, user-friendly mobile app, etc.]

- Cons: [List platform’s weaknesses, such as limited customer support, lack of research tools, etc.]

- Suitable for: [Describe the investor type best suited for this platform, e.g., casual traders, those seeking a simple platform, etc.]

5. [Platform Name]

- Pros: [List platform’s strengths, including strong regulatory oversight, high level of security, etc.]

- Cons: [List platform’s weaknesses, such as limited trading instruments, high account minimums, etc.]

- Suitable for: [Describe the investor type best suited for this platform, e.g., investors seeking a secure and regulated platform, etc.]

Tips for Choosing the Right Gold Trading Platform

1. Research and Compare:

- Don’t rush into a decision: Thoroughly research different platforms, comparing their features, fees, and regulatory oversight.

- Read reviews and testimonials: See what other users have to say about the platform’s performance, customer support, and user experience.

- Consider your trading style: Choose a platform that aligns with your trading goals, risk tolerance, and experience level.

2. Start Small and Gradually Increase Your Investments:

- Don’t invest more than you can afford to lose: Start with a small amount and gradually increase your investment as you gain experience and confidence.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, including gold, to manage risk.

3. Stay Informed and Educate Yourself:

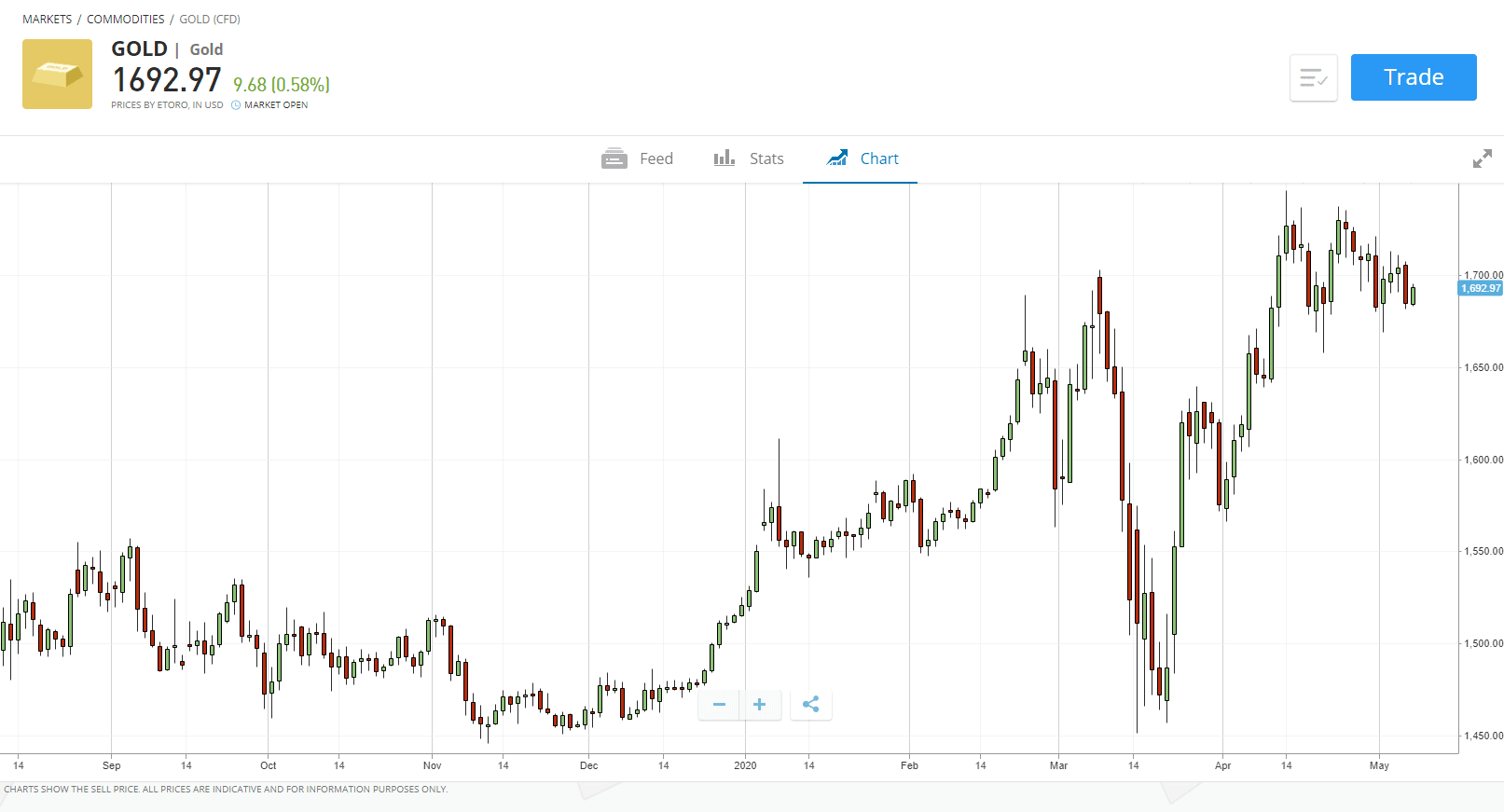

- Keep up with market trends: Monitor gold prices and economic news to make informed trading decisions.

- Learn about gold trading strategies: Explore different trading strategies to optimize your returns.

- Take advantage of educational resources: Many platforms offer webinars, tutorials, and other educational materials to enhance your knowledge.

Conclusion: Your Journey to Gold Trading Success

Choosing the right online gold trading platform is crucial for a successful investment journey. By understanding the fundamentals, considering key factors, and comparing top platforms, you can make an informed decision that aligns with your trading goals and risk tolerance. Remember, investing in gold is a long-term strategy, and patience is key. Stay informed, manage your risk, and enjoy the potential rewards of this precious metal.

FAQs:

1. What is the minimum investment amount required to start trading gold online?

The minimum investment amount varies between platforms. Some platforms may have a minimum account balance requirement, while others may allow you to start with a small amount. It’s important to check the platform’s terms and conditions before opening an account.

2. Are online gold trading platforms safe?

Reputable online gold trading platforms are regulated by financial authorities and have robust security measures in place. However, it’s always essential to research the platform’s regulatory oversight and security features before investing.

3. What are the risks associated with trading gold online?

Trading gold online involves inherent risks, including price volatility, market fluctuations, and potential losses. It’s crucial to understand these risks and manage them effectively.

4. How can I learn more about gold trading?

Many online platforms offer educational resources, tutorials, and webinars to help you learn about gold trading. You can also find valuable information from reputable financial websites and publications.

5. What are the best strategies for trading gold online?

There are various gold trading strategies, including trend following, momentum trading, and arbitrage. The best strategy depends on your trading goals, risk tolerance, and market conditions. It’s essential to research and understand different strategies before implementing them.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to Best Online Gold Trading Platforms: A Comprehensive Review. We hope you find this article informative and beneficial. See you in our next article!