Mastering the Art of Small Business Expense Tracking: A Comprehensive Guide

Related Articles: Mastering the Art of Small Business Expense Tracking: A Comprehensive Guide

- Unlocking Growth: The Power Of Small Business Credit Cards

- What’s The Best Online Business To Start In 2024?

- The Ultimate Guide To Launching A Thriving Online Business In Bangladesh: From Idea To Income

- Finding The Right Fit: Your Guide To The Best Online Business Accounting Software

- Unlock Your Entrepreneurial Spirit: The Ultimate Guide To The Best Online Businesses & Professions

With enthusiasm, let’s navigate through the intriguing topic related to Mastering the Art of Small Business Expense Tracking: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Mastering the Art of Small Business Expense Tracking: A Comprehensive Guide

![]()

Let’s face it, running a small business is a whirlwind of activity. You’re juggling marketing, sales, customer service, and a million other tasks, all while trying to keep your finances in check. But amidst the chaos, one crucial element often gets overlooked: expense tracking.

Think of your business like a ship sailing through a storm. You need a compass to navigate, a rudder to steer, and a map to guide your journey. Expense tracking is your compass, your rudder, and your map, helping you understand your financial health and make informed decisions.

Why is Expense Tracking So Crucial?

Imagine this: you’re working tirelessly, making sales, and feeling like your business is on the right track. But then, tax season rolls around, and you’re left scrambling to gather receipts and invoices, unsure of where your money went. Sound familiar?

This scenario highlights the importance of tracking your expenses. It’s not just about staying organized; it’s about:

- Understanding your cash flow: You need to know where your money is going to make smart decisions about spending, budgeting, and pricing.

- Identifying areas for improvement: Tracking expenses can reveal inefficiencies and areas where you can save money.

- Making informed business decisions: Accurate expense data empowers you to make strategic choices about investments, growth, and even pricing.

- Staying compliant with tax regulations: Accurate records are essential for tax purposes, ensuring you pay the right amount and avoid penalties.

The Power of Data: How Expense Tracking Illuminates Your Business

Expense tracking isn’t just about keeping a spreadsheet of your spending. It’s about transforming raw data into actionable insights. By analyzing your expense trends, you can:

- Identify recurring costs: Are you spending too much on utilities, marketing, or supplies? Tracking reveals patterns that can help you negotiate better rates or find more cost-effective alternatives.

- Pinpoint seasonal fluctuations: Do your expenses spike during certain months? Understanding these patterns can help you adjust your budgeting and pricing strategies.

- Measure the impact of your marketing campaigns: Tracking advertising and promotion costs against sales revenue can reveal which campaigns are driving the most ROI.

- Uncover hidden costs: Are you spending more on travel, entertainment, or office supplies than you realize? Tracking helps you identify these "hidden" expenses and address them proactively.

The Evolution of Expense Tracking: From Spreadsheets to Sophisticated Software

![]()

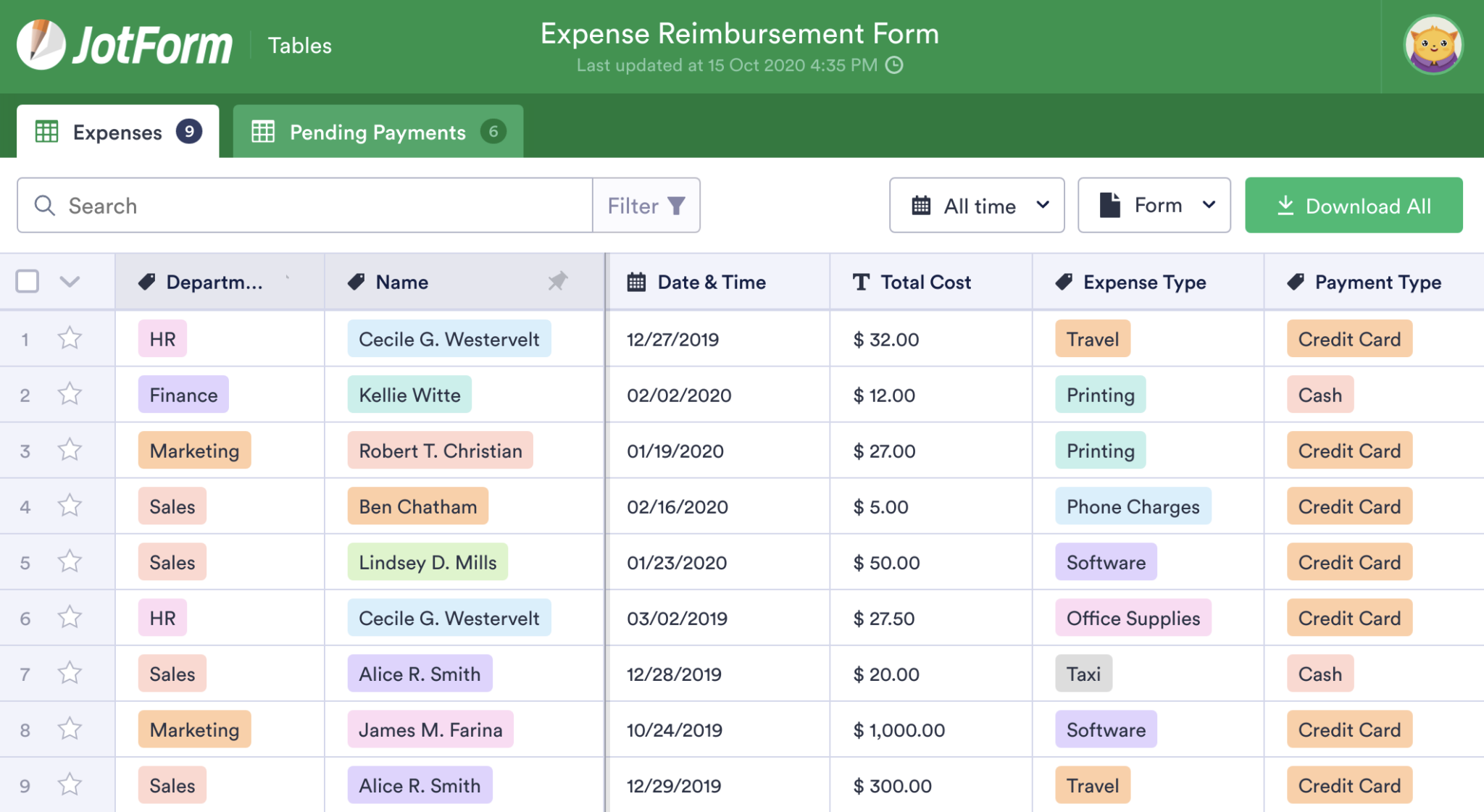

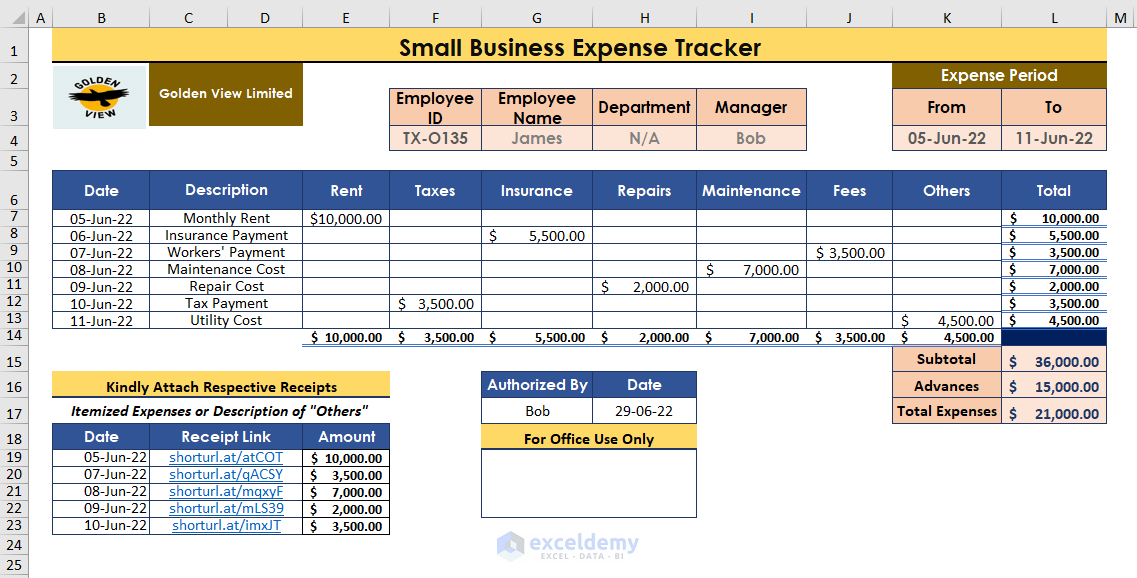

Remember the days of meticulously logging every expense in a physical notebook or spreadsheet? While these methods still have their place, the world of expense tracking has evolved significantly. Today, we have a plethora of tools and software solutions designed to streamline the process and provide valuable insights.

The Benefits of Using Expense Tracking Software

- Automation: Say goodbye to manual data entry! Expense tracking software automatically captures and categorizes your expenses, saving you time and effort.

- Real-time visibility: Get instant access to your financial data, allowing you to monitor your spending and make adjustments as needed.

- Integration with other tools: Connect your expense tracking software with your accounting software, bank accounts, and credit cards for seamless data flow.

- Mobile accessibility: Track expenses on the go with dedicated mobile apps, making it easy to capture receipts and log spending wherever you are.

- Advanced analytics and reporting: Gain deeper insights into your spending habits with customizable reports, graphs, and charts.

Choosing the Right Expense Tracking Software for Your Small Business

With so many options available, choosing the right expense tracking software can seem daunting. But don’t worry, we’re here to help! Consider these factors:

- Your budget: Software options range in price, so determine what fits your budget. Some offer free plans with limited features, while others charge monthly or annual subscriptions.

- Your business needs: What specific features are essential for your business? Do you need support for multiple users, integrations with specific platforms, or advanced reporting capabilities?

- Ease of use: Look for software that is intuitive and easy to navigate, even if you’re not tech-savvy.

- Customer support: Choose a software provider with reliable customer support to help you troubleshoot any issues and get the most out of your investment.

Beyond Software: Effective Expense Tracking Strategies

Expense tracking software is a powerful tool, but it’s just one piece of the puzzle. Here are some additional strategies to enhance your expense management:

1. Set Clear Budgeting Goals

Before you start tracking expenses, define your financial goals. What are you trying to achieve? Are you aiming to increase your profits, pay down debt, or save for a specific investment? Having clear goals will guide your spending decisions.

2. Categorize Your Expenses

Don’t just track your expenses randomly; categorize them to gain valuable insights. Common expense categories include:

- Operating Expenses: Rent, utilities, salaries, marketing, supplies

- Cost of Goods Sold (COGS): Raw materials, inventory, manufacturing costs

- Marketing and Advertising: Online advertising, print ads, social media marketing

- Sales and Distribution: Shipping, delivery, customer service

- Administrative Expenses: Office supplies, accounting fees, legal fees

3. Track Your Expenses Regularly

Don’t wait until the end of the month or year to track your expenses. Make it a habit to log your spending daily or weekly. This allows you to identify potential issues early on and make adjustments before they snowball.

4. Use a System for Receipt Management

Don’t let receipts clutter your desk or get lost in a pile of papers. Implement a system for organizing and storing receipts:

- Digital Receipt Scanning: Use a mobile app or scanner to capture receipts electronically.

- Cloud Storage: Store receipts securely in the cloud for easy access and backup.

- Dedicated File System: Create a folder system for storing receipts by date, category, or vendor.

5. Review Your Expenses Regularly

Don’t just track your expenses; review them regularly to identify areas for improvement. Ask yourself:

- Are there any unnecessary expenses?

- Can you negotiate better rates with vendors?

- Are there more efficient ways to accomplish tasks?

- Are you overspending in any specific categories?

6. Implement a "No Spend" Day

Once a week, challenge yourself to a "no spend" day. This forces you to be more mindful of your spending habits and identify unnecessary purchases.

7. Use the "50/30/20" Budgeting Rule

This popular budgeting method allocates 50% of your income to needs (essentials like rent, utilities, groceries), 30% to wants (entertainment, dining, travel), and 20% to savings and debt repayment.

8. Create a Spending Plan

Instead of simply tracking expenses, create a spending plan for each month. This helps you stay within your budget and prioritize your spending.

9. Automate Your Savings

Set up automatic transfers from your checking account to your savings account. This ensures you’re consistently saving money, even if you forget to do it manually.

10. Utilize the "Envelope System"

This old-school method involves allocating cash to different spending categories (e.g., groceries, entertainment) and using physical envelopes to track your spending. This helps you stay within your budget and avoid overspending.

The Power of Consistency: Turning Expense Tracking into a Habit

The key to successful expense tracking is consistency. Make it a habit, just like brushing your teeth or checking your email. The more you track your expenses, the more insights you’ll gain and the better equipped you’ll be to make informed financial decisions.

The Bottom Line: Expense Tracking is a Game Changer

Don’t underestimate the power of expense tracking. It’s not just about keeping track of your spending; it’s about gaining control of your finances, making informed decisions, and ultimately, growing your business. By embracing expense tracking, you’re taking a proactive step towards a more successful and sustainable future for your small business.

FAQs

1. What are some of the best free expense tracking apps available?

- Mint: A popular option for personal finance management, Mint offers free expense tracking features and budgeting tools.

- Wave: A free accounting software that also includes expense tracking capabilities.

- Zoho Expense: A free version is available for up to 5 users, offering basic expense tracking features.

2. Can I track my expenses without using software?

Yes, you can use spreadsheets or notebooks to track your expenses. However, software offers automation, real-time visibility, and advanced analytics that can make the process more efficient and insightful.

3. How often should I review my expenses?

Review your expenses at least monthly, but ideally weekly or even daily. This allows you to identify potential issues early on and make adjustments as needed.

4. What are some tips for staying motivated with expense tracking?

- Set realistic goals: Don’t try to track every penny; start with a few key categories and gradually expand.

- Make it a habit: Track your expenses consistently, even if it’s just for a few minutes each day.

- Reward yourself: Celebrate small milestones and achievements, such as hitting your savings goal or reducing your expenses by a certain percentage.

- Find an accountability partner: Share your goals and progress with a friend or mentor to stay motivated.

5. How can I make expense tracking easier for my employees?

- Provide clear guidelines: Explain how to track expenses, what documentation is required, and how to submit expense reports.

- Use user-friendly software: Choose software that is easy for employees to use and understand.

- Offer training: Provide training sessions or tutorials to help employees learn how to use the software effectively.

- Provide timely feedback: Review expense reports promptly and provide feedback to employees on their submissions.

Closure

Thus, we hope this article has provided valuable insights into Mastering the Art of Small Business Expense Tracking: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!