QuickBooks Online: Your Guide to Effortless Accounting

Related Articles: QuickBooks Online: Your Guide to Effortless Accounting

- The Business Of Business Administration: Navigating The Complex World Of Management

- Unlock Your Potential: The Ultimate Guide To Online Business Courses

- Unlock Your Potential: The Rise Of Online Courses And Why You Should Care

- Online Business Ideas for Beginners 2024: Launch Your Entrepreneurial Journey

- The Ultimate Guide To Setting Up And Managing A Business Account Online: A Step-by-Step Walkthrough

With enthusiasm, let’s navigate through the intriguing topic related to QuickBooks Online: Your Guide to Effortless Accounting. Let’s weave interesting information and offer fresh perspectives to the readers.

QuickBooks Online: Your Guide to Effortless Accounting

Let’s face it, managing your business finances can feel like a never-ending chore. You’re constantly juggling invoices, tracking expenses, and trying to stay on top of your cash flow. It’s enough to make anyone want to bury their head in the sand. But what if I told you there was a way to streamline your accounting process and actually enjoy it? That’s where QuickBooks Online comes in.

What is QuickBooks Online?

QuickBooks Online is a cloud-based accounting software that helps small businesses manage their finances. It’s like having a virtual accountant at your fingertips, providing you with all the tools you need to stay organized and make informed financial decisions.

Why Should You Use QuickBooks Online?

Imagine this: you’re sitting at your desk, sipping your morning coffee, and you need to check your latest sales figures. With QuickBooks Online, you can access your financial data from anywhere, anytime, on any device. No more digging through dusty files or scrambling for spreadsheets.

Key Features of QuickBooks Online:

QuickBooks Online is packed with features that can help you manage your business finances like a pro. Here are some of the key highlights:

1. Invoice Creation and Management:

Say goodbye to tedious manual invoicing! QuickBooks Online allows you to create professional-looking invoices in minutes, track their status, and get paid faster. You can even send invoices directly from your phone, making it easier than ever to manage your billing.

2. Expense Tracking:

Keeping track of your expenses can feel like a never-ending game of whack-a-mole. But with QuickBooks Online, you can easily categorize and track your expenses, ensuring you never miss a deduction. You can even connect your bank accounts and credit cards to automate the process.

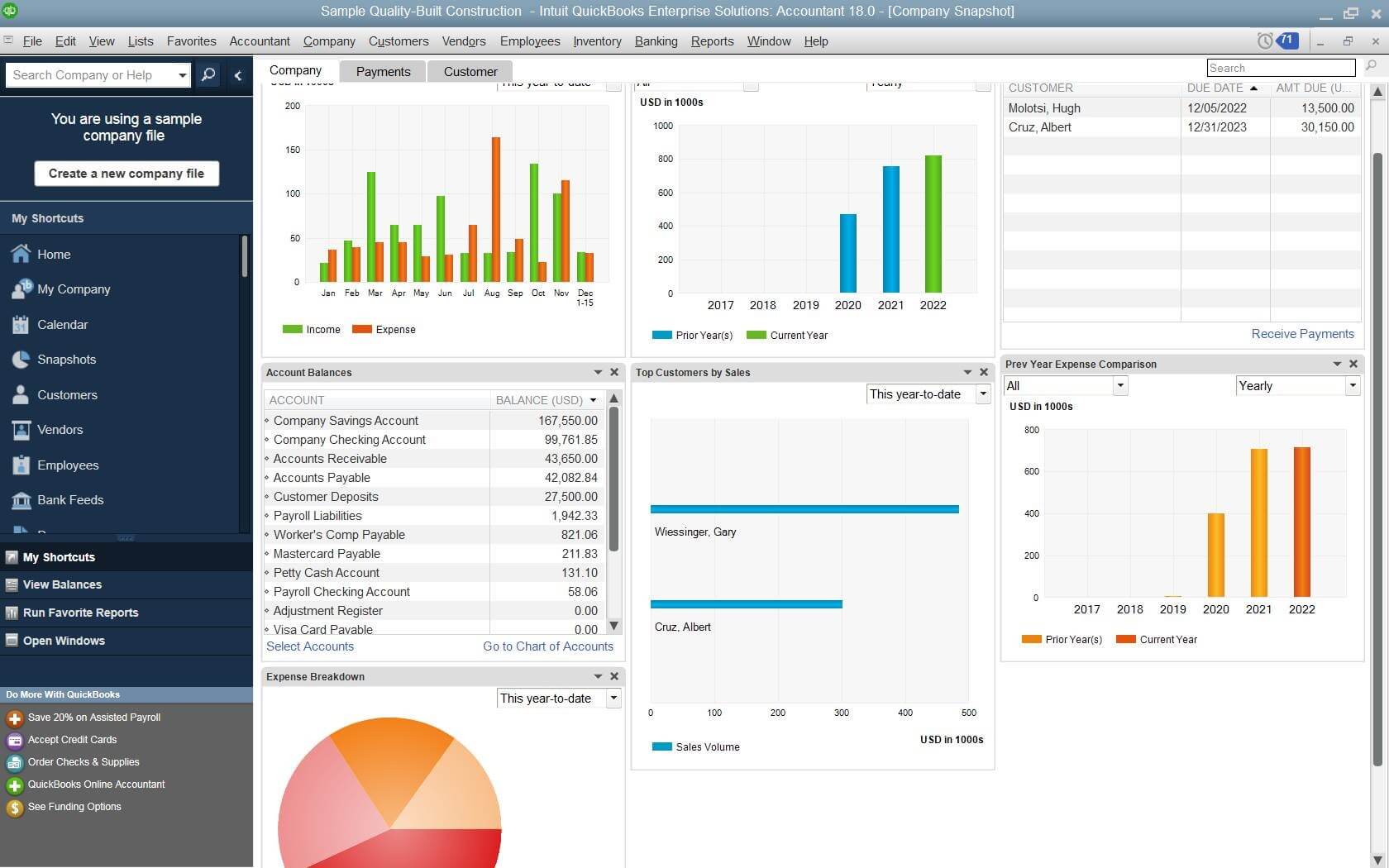

3. Reporting and Analytics:

Making informed financial decisions requires data, and QuickBooks Online provides you with all the insights you need. You can generate custom reports on your sales, expenses, profit margins, and more. This data can help you identify areas for improvement and make strategic decisions for your business growth.

4. Bank Reconciliation:

Bank reconciliation is a crucial but often overlooked task. QuickBooks Online simplifies this process by automatically matching your bank transactions to your account records. This ensures your financial records are accurate and up-to-date.

5. Payroll Management:

Paying your employees on time and accurately is essential for maintaining a happy workforce. QuickBooks Online offers a payroll solution that can help you manage payroll taxes, direct deposits, and employee benefits.

QuickBooks Online vs. Traditional Accounting Software:

For years, businesses relied on traditional desktop accounting software. But the cloud has revolutionized the way we manage our finances, and QuickBooks Online offers several advantages over its traditional counterparts:

1. Accessibility:

Access your financial data from anywhere, anytime, on any device. You’re not limited to your office computer.

2. Real-Time Updates:

Cloud-based software updates automatically, ensuring you always have the latest features and security updates.

3. Collaboration:

Multiple users can access and collaborate on financial data simultaneously, making it easier to manage your finances as a team.

4. Cost-Effective:

Cloud-based software often comes with a subscription-based pricing model, making it a more cost-effective solution compared to traditional software that requires upfront investments.

Choosing the Right QuickBooks Online Plan:

QuickBooks Online offers various plans tailored to different business needs and budgets. Here’s a breakdown of the key plans:

1. Simple Start:

This plan is ideal for small businesses with basic accounting needs. It includes features like invoicing, expense tracking, and bank reconciliation.

2. Essentials:

This plan offers more advanced features like inventory management, reporting, and customer management. It’s suitable for businesses that need more robust financial management tools.

3. Plus:

This plan is designed for businesses with more complex needs, including advanced reporting, budgeting, and forecasting tools.

4. Advanced:

This plan is the most comprehensive option, offering features like project management, time tracking, and advanced inventory management. It’s suitable for businesses with complex financial operations.

Getting Started with QuickBooks Online:

Ready to embrace the world of effortless accounting? Here’s how you can get started with QuickBooks Online:

1. Sign Up for a Free Trial:

QuickBooks Online offers a free trial so you can test out the software before committing. This gives you a chance to explore the features and see if it’s the right fit for your business.

2. Import Your Existing Data:

If you’re switching from another accounting software, you can import your existing data into QuickBooks Online. This ensures a smooth transition and eliminates the need to manually enter your information.

3. Set Up Your Chart of Accounts:

Your chart of accounts is the backbone of your accounting system. QuickBooks Online provides a guided setup process to help you create a comprehensive chart of accounts that meets your business needs.

4. Connect Your Bank Accounts:

Connecting your bank accounts to QuickBooks Online allows for automatic bank reconciliation and expense tracking. This simplifies the process and ensures your financial records are accurate and up-to-date.

Tips for Using QuickBooks Online Effectively:

Here are some tips to help you make the most of your QuickBooks Online experience:

1. Stay Organized:

Use QuickBooks Online’s features to categorize your transactions, track your invoices, and organize your financial data. This will make it easier to find what you need and ensure your records are accurate.

2. Regularly Reconcile Your Accounts:

Reconciling your bank accounts with your QuickBooks Online records is crucial for maintaining accurate financial data. Make this a regular habit to avoid discrepancies and ensure your financial statements are reliable.

3. Take Advantage of Reporting:

QuickBooks Online provides a wealth of reporting tools. Use them to track your sales, expenses, profit margins, and other key metrics. This data can help you make informed decisions and identify areas for improvement.

4. Utilize QuickBooks Online’s Mobile App:

The QuickBooks Online mobile app allows you to access your financial data from anywhere, anytime. This makes it easy to track your finances on the go, send invoices, and manage your expenses.

5. Explore QuickBooks Online’s Marketplace:

The QuickBooks Online Marketplace offers a wide range of third-party apps that can integrate with your account. These apps can help you automate tasks, enhance your workflow, and expand the functionality of QuickBooks Online.

Case Studies:

1. The Small Business Owner:

Sarah, a small business owner, was struggling to keep track of her finances. She was using spreadsheets and manual invoicing, which was time-consuming and prone to errors. Sarah switched to QuickBooks Online and was amazed by how much easier it was to manage her finances. She could track her expenses, create invoices, and generate reports with ease. QuickBooks Online helped Sarah save time and gain valuable insights into her business performance.

2. The Freelancer:

John, a freelance writer, was having trouble managing his invoicing and expense tracking. He was using a combination of different tools, which made it difficult to get a clear picture of his finances. John decided to try QuickBooks Online and was impressed by its user-friendliness and comprehensive features. He could easily create invoices, track his expenses, and generate reports to monitor his income and expenses. QuickBooks Online helped John streamline his financial management and gain more control over his business.

Addressing Concerns:

While QuickBooks Online offers numerous benefits, some concerns might arise:

1. Learning Curve:

Some users might find the initial learning curve to be steep. However, QuickBooks Online offers excellent resources, including tutorials, online help, and customer support, to help you get started.

2. Security:

As a cloud-based software, security is a concern for some users. QuickBooks Online employs robust security measures, including data encryption, multi-factor authentication, and regular security audits.

3. Internet Connectivity:

Since QuickBooks Online is cloud-based, you need a stable internet connection to access the software. This could be a challenge for businesses with limited internet access.

Conclusion:

QuickBooks Online is a game-changer for small businesses looking to streamline their accounting process. Its user-friendly interface, comprehensive features, and cloud-based accessibility make it a powerful tool for managing your finances and growing your business. While some challenges exist, the benefits of QuickBooks Online far outweigh the concerns.

Embrace the power of cloud-based accounting and take control of your financial future. QuickBooks Online is your trusted partner on your journey to financial success.

FAQs:

1. What is the cost of QuickBooks Online?

QuickBooks Online offers various plans with different pricing options. You can find the pricing details on the QuickBooks Online website.

2. Is QuickBooks Online suitable for all businesses?

QuickBooks Online is designed for small and medium-sized businesses. It can be used by businesses in various industries, including retail, services, manufacturing, and more.

3. Can I access QuickBooks Online from my mobile device?

Yes, QuickBooks Online has a mobile app available for iOS and Android devices. This allows you to access your financial data from anywhere, anytime.

4. How secure is QuickBooks Online?

QuickBooks Online uses robust security measures, including data encryption, multi-factor authentication, and regular security audits.

5. What kind of support is available for QuickBooks Online users?

QuickBooks Online offers various support options, including online help, tutorials, and customer support. You can also find a wealth of resources on the QuickBooks Online website and community forums.

Closure

Thus, we hope this article has provided valuable insights into QuickBooks Online: Your Guide to Effortless Accounting. We appreciate your attention to our article. See you in our next article!