The Silent Crisis: Why Small Businesses Are Filing for Bankruptcy in Record Numbers

Related Articles: The Silent Crisis: Why Small Businesses Are Filing for Bankruptcy in Record Numbers

- Your Daily Dose Of Business Brilliance: The Best Online Business News Websites

- The Ultimate Guide To Choosing The Best Online Business Bank Account For Startups

- Unlocking Your Entrepreneurial Dreams: The Ultimate Guide To Buying The Best Online Business

- Unlocking Your Ethiopian Dream: The Best Online Businesses To Launch In 2023

- Best Online Business Courses UK: Level Up Your Skills And Launch Your Dream Career

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Silent Crisis: Why Small Businesses Are Filing for Bankruptcy in Record Numbers. Let’s weave interesting information and offer fresh perspectives to the readers.

The Silent Crisis: Why Small Businesses Are Filing for Bankruptcy in Record Numbers

It’s a scene we’ve all witnessed: the "For Lease" sign in the window of a beloved local bakery, the empty storefront where a quirky bookstore once thrived, the familiar face behind the counter now replaced with a "Closed" sign. These are the everyday casualties of a silent crisis: the rising tide of small business bankruptcies. While the headlines might be dominated by tech giants and corporate giants, the reality is that small businesses are the backbone of our economy, and their struggles are a harbinger of broader economic woes.

The Numbers Tell a Grim Tale

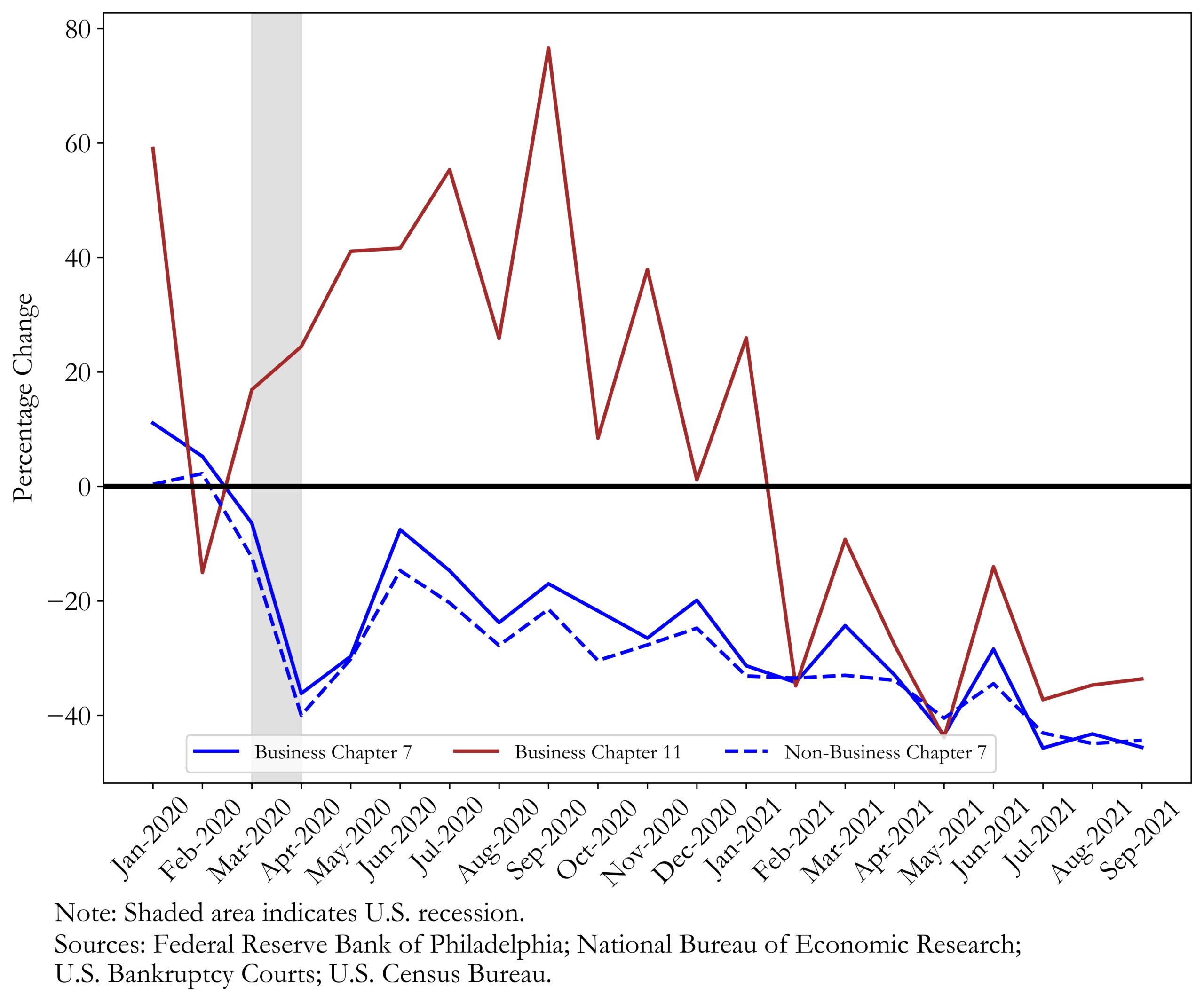

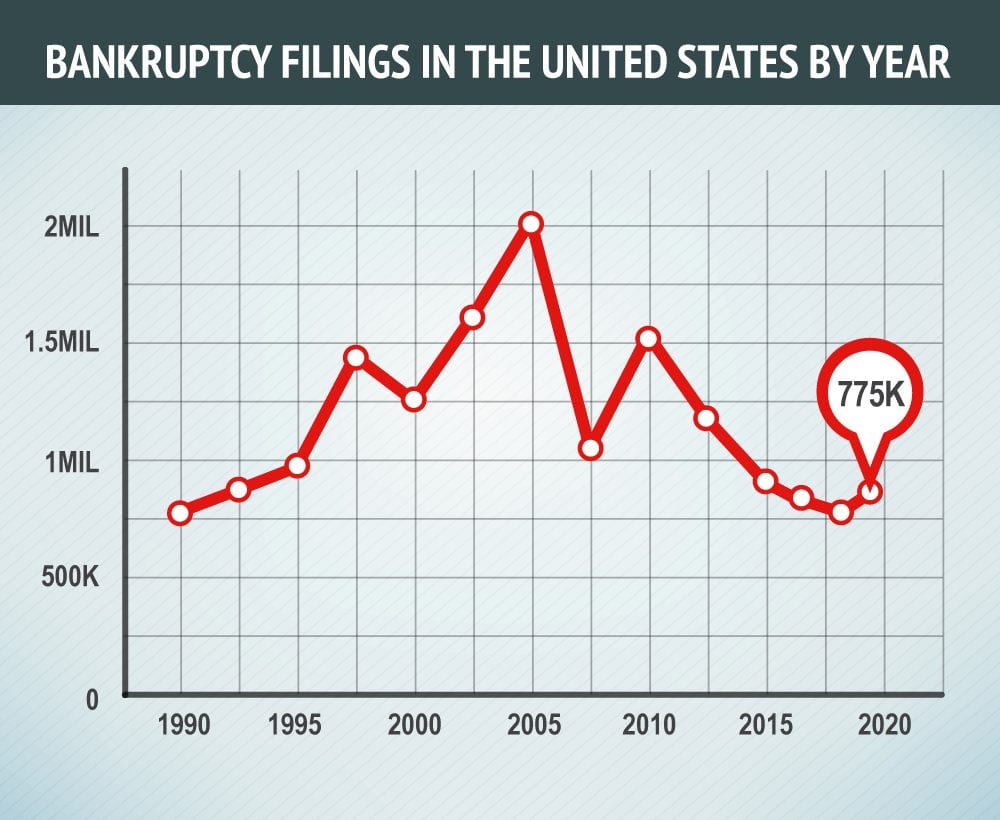

The data paints a stark picture. According to the U.S. Bankruptcy Court, Chapter 7 filings (liquidation) by small businesses have surged in recent years. The impact is felt across industries, from restaurants and retail shops to construction and manufacturing. This isn’t just a localized phenomenon; it’s a nationwide trend, with implications for communities, families, and the overall economic landscape.

Why Are Small Businesses Failing?

The reasons for this alarming trend are multifaceted, intertwined with a complex web of economic forces and societal shifts.

1. The Pandemic’s Lingering Shadow

The COVID-19 pandemic dealt a devastating blow to small businesses. Lockdowns, supply chain disruptions, and shifting consumer behavior created a perfect storm that many businesses couldn’t weather. Even as the economy recovers, the pandemic’s scars remain, with ongoing inflation and labor shortages adding to the pressure.

2. The Rising Tide of Inflation

Inflation has eroded purchasing power, forcing consumers to tighten their belts. Small businesses, often operating on tight margins, find it difficult to absorb these rising costs and pass them on to customers without jeopardizing sales. The squeeze between rising expenses and stagnant revenue is a recipe for disaster.

3. The Labor Shortage and Rising Wages

The tight labor market has pushed wages up, putting pressure on small businesses already struggling with tight margins. Finding qualified workers is a constant challenge, and the cost of hiring and retaining employees has become a significant burden.

4. The Evolving Landscape of E-commerce

The rise of e-commerce has transformed consumer behavior, with online shopping becoming the norm for many. Traditional brick-and-mortar businesses are struggling to adapt to this shift, facing competition from online giants with vast resources and economies of scale.

5. The Burden of Debt

Many small businesses are saddled with debt, often taken on to weather the pandemic or invest in growth. Rising interest rates make it harder to manage debt payments, further straining their finances.

The Human Cost of Small Business Bankruptcies

The impact of small business failures extends beyond economic statistics. It’s a human story of dreams shattered, livelihoods lost, and communities left with empty storefronts. Consider the local bakery owner who poured her life savings into her dream, only to see it crumble under the weight of debt and competition. Or the family-owned hardware store that has been a fixture in the neighborhood for generations, now forced to close its doors. These are not just business failures; they are stories of personal hardship and resilience.

Beyond the Numbers: Understanding the Causes

To truly understand the crisis of small business bankruptcies, we need to delve deeper than just the numbers. It’s about understanding the underlying factors that contribute to their vulnerability.

1. Lack of Access to Capital

Small businesses often struggle to secure financing, particularly during challenging economic times. Banks and investors are often hesitant to lend to startups or businesses with limited track records, leaving many entrepreneurs with few options.

2. The Regulatory Burden

Navigating a complex web of regulations can be a daunting task for small business owners, consuming time and resources that could be better spent on growing their businesses.

3. The Digital Divide

The rapid pace of technological advancements has created a digital divide, with some small businesses struggling to keep up. Adapting to online marketing, e-commerce platforms, and digital payment systems can be a significant hurdle, particularly for older businesses or those operating in rural areas.

4. The Lack of Support Networks

Small business owners often lack access to mentors, advisors, and support networks that can provide guidance and resources. This isolation can make it difficult to navigate challenges and access the help they need.

The Ripple Effect: Beyond the Individual Business

The closure of a small business has a ripple effect that extends far beyond the individual entrepreneur.

1. Job Losses and Economic Strain

When a small business fails, it often leads to job losses, impacting the livelihoods of employees and their families. This loss of income can have a cascading effect on the local economy, reducing consumer spending and further weakening the business environment.

2. Reduced Tax Revenue

Small businesses are a significant source of tax revenue for local governments. Their closures can lead to reduced tax revenue, making it more challenging for communities to fund essential services like schools, infrastructure, and public safety.

3. The Loss of Local Character

Small businesses often define the character of a neighborhood, providing a sense of community and identity. Their closures can lead to a homogenization of the retail landscape, with big-box stores and chain businesses replacing the unique offerings of local businesses.

Navigating the Storm: Strategies for Survival

While the situation is challenging, there are steps that small businesses can take to navigate the storm and increase their chances of survival.

1. Embrace Digital Transformation

The digital landscape is evolving rapidly, and small businesses need to adapt to stay competitive. Investing in online marketing, e-commerce platforms, and digital payment systems can help them reach a wider audience and compete with larger online retailers.

2. Build Strong Relationships with Customers

Cultivating strong relationships with customers is essential for small businesses. Providing exceptional customer service, fostering loyalty, and creating a sense of community can help them stand out in a crowded marketplace.

3. Seek Out Support Networks

Connecting with other small business owners, mentors, and industry organizations can provide valuable insights, resources, and support. Networking can help small businesses access financing, learn best practices, and stay informed about industry trends.

4. Adapt to Changing Consumer Behavior

Small businesses need to be flexible and adaptable to changing consumer preferences. Understanding evolving trends, incorporating new technologies, and offering products and services that meet the needs of their target audience can help them stay ahead of the curve.

5. Focus on Sustainability

Building a sustainable business model is crucial for long-term success. This involves controlling costs, managing inventory efficiently, and exploring ways to reduce environmental impact.

A Call to Action: Supporting Small Businesses

The survival of small businesses is not just an economic imperative; it’s a matter of community and social well-being. We all have a role to play in supporting these vital engines of our economy.

1. Shop Local

Make a conscious effort to patronize local businesses whenever possible. This not only helps support their bottom line but also contributes to the vibrancy and diversity of our communities.

2. Advocate for Small Businesses

Support initiatives that promote small business growth and development. Contact your elected officials and advocate for policies that create a more favorable environment for small businesses to thrive.

3. Offer Mentorship and Support

If you have experience in business or have skills that can benefit small business owners, consider offering your time and expertise as a mentor. Sharing your knowledge and experience can make a significant difference in the success of a small business.

4. Spread the Word

Share positive stories about local businesses and their contributions to the community. Amplify their voices and promote their products and services through social media and word-of-mouth.

Conclusion

The crisis of small business bankruptcies is a complex issue with far-reaching consequences. It’s a reminder of the fragility of our economy and the vital role that small businesses play in our communities. While the challenges are significant, there are steps we can take to mitigate the crisis and create a more supportive environment for small businesses to thrive. By understanding the causes, supporting their efforts, and advocating for policies that foster their growth, we can help ensure that the heart and soul of our economy continues to beat strong.

FAQs:

1. What are the most common reasons for small business bankruptcies?

The most common reasons include:

- Economic downturns: Recessions, pandemics, and other economic shocks can severely impact small businesses.

- Competition: The rise of e-commerce and larger corporations can make it difficult for small businesses to compete.

- Debt: High debt levels, particularly from loans taken on during difficult times, can become unsustainable.

- Lack of capital: Small businesses often struggle to access financing, limiting their ability to invest in growth or weather economic storms.

2. How can I support a small business in my community?

- Shop local: Make a conscious effort to patronize local businesses whenever possible.

- Spread the word: Share positive reviews and recommendations for local businesses on social media and through word-of-mouth.

- Offer mentorship: If you have experience in business, consider offering your time and expertise as a mentor to a local small business owner.

3. What resources are available for small businesses facing financial difficulties?

- Small Business Administration (SBA): The SBA offers loans, grants, and other resources to help small businesses start, grow, and recover from disasters.

- SCORE: SCORE is a non-profit organization that provides free mentoring and training to small business owners.

- Local Chambers of Commerce: Chambers of Commerce often offer resources and support to small businesses in their communities.

4. What steps can small businesses take to improve their chances of survival?

- Embrace digital transformation: Invest in online marketing, e-commerce platforms, and digital payment systems to reach a wider audience.

- Build strong customer relationships: Provide exceptional customer service, foster loyalty, and create a sense of community.

- Seek out support networks: Connect with other small business owners, mentors, and industry organizations for guidance and resources.

- Adapt to changing consumer behavior: Understand evolving trends and offer products and services that meet the needs of their target audience.

- Focus on sustainability: Control costs, manage inventory efficiently, and explore ways to reduce environmental impact.

5. What are some of the long-term implications of small business bankruptcies?

- Job losses: Small business failures can lead to job losses, impacting the livelihoods of employees and their families.

- Reduced tax revenue: Small businesses are a significant source of tax revenue for local governments. Their closures can lead to reduced tax revenue, making it more challenging for communities to fund essential services.

- Loss of local character: Small businesses often define the character of a neighborhood, providing a sense of community and identity. Their closures can lead to a homogenization of the retail landscape.

Closure

Thus, we hope this article has provided valuable insights into The Silent Crisis: Why Small Businesses Are Filing for Bankruptcy in Record Numbers. We hope you find this article informative and beneficial. See you in our next article!