The Ultimate Guide to Choosing the Best Online Business Banking App: Navigate the Digital Landscape with Ease

Related Articles: The Ultimate Guide to Choosing the Best Online Business Banking App: Navigate the Digital Landscape with Ease

- The Power Of A Business Management Degree: Unlocking Your Career Potential

- Unlocking The Power Of Data: Your Guide To The Best Online Business Analytics Courses

- Best Online Businesses To Start In Australia: Your Guide To Success

- Easy Online Business Ideas 2024: Your Path to Success

- The Power Of Pocket-Sized Marketing: Why Business Cards Still Matter In The Digital Age

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Ultimate Guide to Choosing the Best Online Business Banking App: Navigate the Digital Landscape with Ease. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to Choosing the Best Online Business Banking App: Navigate the Digital Landscape with Ease

Let’s face it, running a business in the digital age means you need a banking solution that’s as agile and efficient as you are. Gone are the days of long lines at the bank and endless paperwork. Today, the world of business banking has gone mobile, and the right online banking app can be your secret weapon for success. But with so many options out there, how do you choose the best one for your needs?

Understanding Your Needs: The Foundation for a Successful Search

Before diving into the sea of apps, it’s essential to understand your unique business requirements. Think about your daily operations, financial needs, and the features that would streamline your workflow.

H3: What are your core banking needs?

- Transaction Volume: Are you handling a high volume of transactions daily, or are your needs more moderate?

- Payment Processing: Do you need to accept payments online, process payroll, or manage recurring invoices?

- Account Types: What types of accounts do you require? (e.g., checking, savings, business credit cards, lines of credit)

- Reporting and Analytics: Do you need detailed financial reports, budgeting tools, or insights into your cash flow?

H3: What features are non-negotiable?

- Mobile Deposits: Can you deposit checks directly from your phone?

- Bill Pay: Can you schedule and track payments online?

- Account Transfers: Can you easily transfer funds between accounts?

- Customer Support: Is there reliable customer service available through the app or website?

H3: What are your security concerns?

- Two-Factor Authentication: Does the app offer multi-factor authentication for added security?

- Fraud Protection: What measures are in place to protect you from fraud and unauthorized transactions?

- Data Encryption: Are your financial data and personal information securely encrypted?

Navigating the App Landscape: Key Features and Considerations

Once you’ve defined your needs, you can start exploring the vast landscape of online banking apps. Here’s a breakdown of key features to consider:

H3: User Interface and User Experience (UI/UX):

- Intuitive Navigation: The app should be easy to navigate and understand, with clear menus and intuitive features.

- Visual Appeal: A visually appealing interface can make banking more enjoyable and engaging.

- Mobile Optimization: The app should be optimized for both Android and iOS devices, ensuring a seamless experience across platforms.

H3: Account Management:

- Account Overview: A clear dashboard that provides a snapshot of your account balances, recent transactions, and upcoming payments.

- Transaction History: Detailed records of all your transactions, including date, time, amount, and payee.

- Account Reconciliation: Tools to help you reconcile your bank statements with your business records.

H3: Payment Processing and Transfers:

- Online Payment Processing: Ability to accept payments directly through the app or integrate with third-party payment gateways.

- ACH Transfers: Seamless transfers between your bank accounts and other financial institutions.

- Wire Transfers: Secure and efficient wire transfers for large transactions.

H3: Reporting and Analytics:

- Customizable Reports: Ability to generate custom reports based on your specific needs.

- Financial Insights: Tools to analyze your cash flow, track expenses, and identify trends.

- Budgeting Tools: Features to help you create and manage your business budget.

H3: Security and Privacy:

- Multi-Factor Authentication: An extra layer of security that requires multiple forms of verification before accessing your account.

- Fraud Detection and Prevention: Advanced security measures to protect your account from unauthorized access and fraudulent transactions.

- Data Encryption: All your financial data and personal information should be securely encrypted.

H3: Customer Support:

- 24/7 Availability: Access to customer support through the app, website, or phone, even outside of business hours.

- Responsive and Helpful: A team of knowledgeable and helpful customer support agents who can assist you with any questions or issues.

Real-World Examples: Putting the Theory into Practice

Let’s dive into some real-world examples of popular online business banking apps and their key features:

H3: Example 1: Chase Business Banking App

- Pros:

- User-friendly interface with a clear dashboard and intuitive navigation.

- Robust features for account management, payments, and reporting.

- Secure platform with multi-factor authentication and fraud protection.

- Cons:

- Limited mobile deposit functionality compared to some competitors.

- Customer support can be difficult to reach at times.

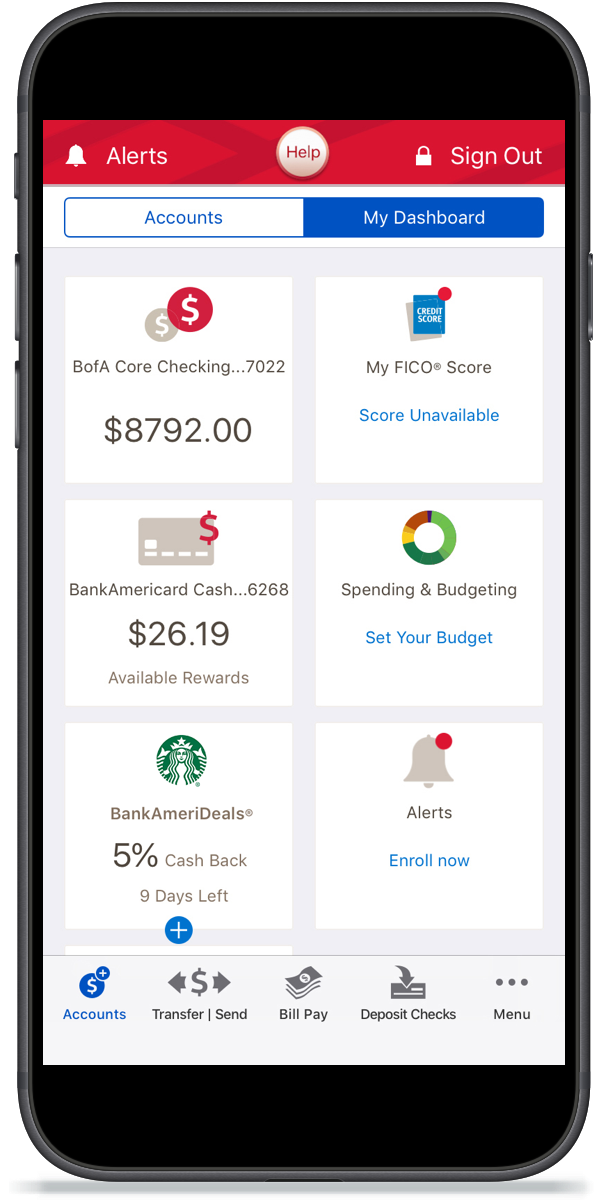

H3: Example 2: Bank of America Business Banking App

- Pros:

- Extensive mobile deposit capabilities, allowing you to deposit checks directly from your phone.

- Advanced budgeting tools and financial insights to help you manage your cash flow.

- Excellent customer support with multiple channels for assistance.

- Cons:

- The app can feel cluttered and overwhelming for some users.

- Limited integration with third-party accounting software.

H3: Example 3: Wells Fargo Business Banking App

- Pros:

- Seamless integration with Wells Fargo’s online banking platform, providing a unified experience.

- Strong security features, including multi-factor authentication and data encryption.

- User-friendly interface with a focus on simplicity and clarity.

- Cons:

- Limited mobile deposit functionality, requiring you to visit a branch for certain types of deposits.

- The app lacks some advanced features found in other competitors.

Addressing Potential Concerns and Counterarguments

Choosing the right online banking app is a personal decision that depends on your specific needs and preferences. Some may argue that traditional banking methods are more secure or offer better customer support. However, the digital landscape is constantly evolving, and online banking apps are becoming increasingly sophisticated and secure.

H3: Counterargument 1: Security Concerns

While security is a valid concern, reputable online banking apps prioritize the protection of your financial data. They employ multi-factor authentication, data encryption, and advanced fraud detection systems to safeguard your account.

H3: Counterargument 2: Customer Support Limitations

While online customer support may not always be as personal as in-person interactions, many apps offer 24/7 availability through multiple channels, including chat, email, and phone. It’s essential to research the customer support options before choosing an app.

H3: Counterargument 3: Lack of Personalization

While online banking apps may not offer the same level of personalized service as a local branch, they often provide customizable settings, reports, and notifications to meet your specific needs.

Conclusion: Embracing the Future of Business Banking

Choosing the best online business banking app is a journey, not a destination. By understanding your needs, exploring the features available, and considering the pros and cons of different apps, you can find the perfect solution to streamline your business operations and empower your financial success.

Remember, the digital landscape is constantly evolving, so it’s crucial to stay informed about the latest trends and innovations in online banking. As new features and technologies emerge, you can adapt your chosen app to meet your evolving needs and stay ahead of the curve.

FAQs:

Q1: What are the best online banking apps for small businesses?

A1: Some popular options for small businesses include Chase Business Banking, Bank of America Business Banking, Wells Fargo Business Banking, and Capital One Spark Business.

Q2: How secure are online banking apps?

A2: Reputable online banking apps prioritize security with multi-factor authentication, data encryption, and advanced fraud detection systems. It’s important to choose an app with a strong security track record.

Q3: What are the benefits of using an online banking app for my business?

A3: Online banking apps offer numerous benefits, including convenience, efficiency, real-time access to your finances, mobile deposits, bill pay, and advanced reporting tools.

Q4: How do I choose the right online banking app for my business?

A4: Consider your business needs, the features offered by different apps, security considerations, customer support options, and user reviews.

Q5: What are the latest trends in online business banking?

A5: Some recent trends include the integration of artificial intelligence (AI) for personalized financial insights, mobile payments, and blockchain technology for secure and transparent transactions.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to Choosing the Best Online Business Banking App: Navigate the Digital Landscape with Ease. We thank you for taking the time to read this article. See you in our next article!