The Ultimate Small Business Bookkeeping Template: Your Guide to Financial Success

Related Articles: The Ultimate Small Business Bookkeeping Template: Your Guide to Financial Success

- Finding Your Perfect Holiday: A Guide To The Best Online Travel Companies

- Your Daily Dose Of Business Brilliance: The Best Online Business News Websites

- Unlock Your Entrepreneurial Spirit: The Best Online Businesses To Start In South Africa

- The Ultimate Guide To Best Online Business Management Degrees: Your Path To Success

- The Ultimate Guide To Starting A Profitable Online Business In Canada In 2024

With great pleasure, we will explore the intriguing topic related to The Ultimate Small Business Bookkeeping Template: Your Guide to Financial Success. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Small Business Bookkeeping Template: Your Guide to Financial Success

Let’s face it, bookkeeping isn’t exactly the most glamorous aspect of running a business. It can feel like a chore, a tedious task that’s always lurking in the back of your mind. But here’s the thing: bookkeeping is the backbone of your business. It’s the foundation upon which you build financial stability, track your progress, and make informed decisions.

Think of it this way: imagine trying to navigate a bustling city without a map. You might stumble upon some interesting sights, but you’ll likely get lost, waste time, and miss out on the best experiences. Bookkeeping is your map, guiding you through the complexities of your business finances and ensuring you reach your destination – financial success.

This guide will provide you with a comprehensive, easy-to-follow bookkeeping template specifically designed for small businesses. We’ll explore the essential elements, practical tips, and essential tools that will empower you to take control of your finances and make informed decisions for your business’s future.

Why is Bookkeeping Crucial for Small Businesses?

You might be thinking, "I’m a small business owner, I’m not a financial expert. Bookkeeping seems complicated, and I have so much else on my plate!" But here’s why you can’t afford to ignore bookkeeping:

- Financial Clarity: Bookkeeping provides a clear picture of your business’s financial health, allowing you to track income, expenses, and profit margins. This insight is vital for making informed decisions, identifying areas for improvement, and ensuring your business is on the right track.

- Tax Compliance: Accurate bookkeeping is essential for filing your taxes correctly and avoiding penalties. It helps you keep track of all your business transactions, ensuring you have the documentation you need to file your returns accurately.

- Investment & Funding: When seeking funding or investors, a well-maintained bookkeeping system demonstrates your business’s financial stability and transparency. It instills confidence in potential investors and increases your chances of securing the necessary capital.

- Growth & Expansion: Understanding your financial performance through bookkeeping allows you to identify opportunities for growth and expansion. You can pinpoint areas where you can invest more, allocate resources efficiently, and make strategic decisions for future growth.

Essential Bookkeeping Components: Building Your Financial Foundation

Imagine building a house without a solid foundation. It wouldn’t stand the test of time, right? The same applies to your business finances. A robust bookkeeping system requires these key components:

1. Chart of Accounts: The Blueprint for Your Business

Think of your chart of accounts as the blueprint for your business’s financial structure. It’s a comprehensive list of all your accounts, organized into categories like assets, liabilities, equity, income, and expenses.

- Assets: These are the things your business owns, including cash, accounts receivable (money owed to you), inventory, and equipment.

- Liabilities: These are the debts your business owes, such as loans, accounts payable (money owed to others), and accrued expenses.

- Equity: This represents the owner’s investment in the business, including initial contributions and accumulated profits.

- Income: This is the revenue your business generates from sales of goods or services.

- Expenses: These are the costs incurred in running your business, such as rent, salaries, utilities, and marketing.

2. Income & Expenses: Tracking Your Business’s Financial Pulse

Income: This is the lifeblood of your business. It’s the money you receive from your customers for the goods or services you provide.

Expenses: These are the costs associated with generating your income. Think of them as the "necessary evils" of running a business.

How to Track Income & Expenses:

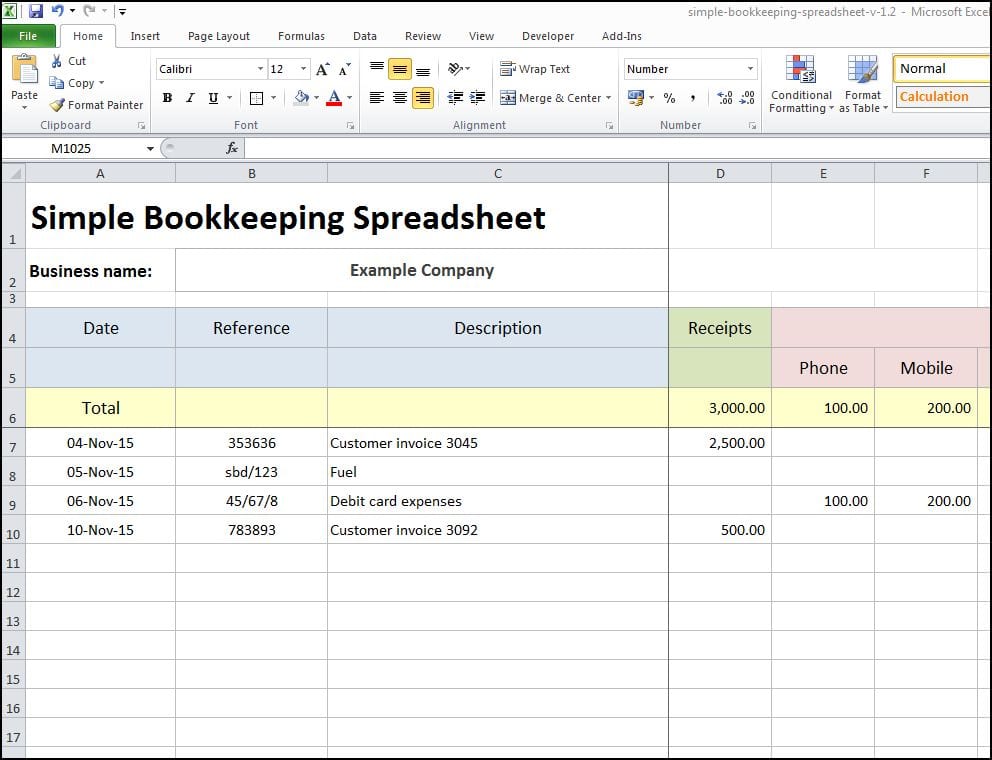

- Use a Spreadsheet: A simple spreadsheet can be a great starting point for tracking income and expenses. You can create separate columns for each category, making it easy to categorize and track your transactions.

- Accounting Software: For more complex businesses, accounting software like QuickBooks or Xero is a powerful tool that automates many bookkeeping tasks. They offer features like invoicing, expense tracking, and bank reconciliation, making it easier to manage your finances.

3. Bank Reconciliation: Ensuring Your Records Match Reality

Bank reconciliation is the process of comparing your bank statement to your bookkeeping records. It’s crucial for identifying discrepancies and ensuring that your books are accurate.

Why is Bank Reconciliation Important?

- Errors & Omissions: It helps identify errors or omissions in your bookkeeping records, such as missed transactions or incorrect entries.

- Fraud Detection: It can help detect potential fraud or unauthorized transactions.

- Financial Accuracy: It ensures that your financial statements are accurate and reflect the true financial position of your business.

4. Financial Statements: The Story Your Numbers Tell

Financial statements are like snapshots of your business’s financial health at a specific point in time. They provide a clear picture of your income, expenses, assets, liabilities, and equity.

Types of Financial Statements:

- Income Statement (Profit & Loss Statement): This statement shows your business’s revenue and expenses over a specific period, revealing your net income or loss.

- Balance Sheet: This statement shows your business’s assets, liabilities, and equity at a specific point in time. It provides a snapshot of your financial position.

- Cash Flow Statement: This statement shows the movement of cash in and out of your business over a specific period. It helps you understand your cash flow and make informed decisions about your finances.

Essential Bookkeeping Tips: Mastering the Art of Financial Management

Now that you understand the essential components of bookkeeping, let’s dive into some practical tips to help you manage your finances efficiently:

1. Embrace Technology: Leverage Tools to Streamline Your Process

In today’s digital age, there’s no need to struggle with manual bookkeeping. Embrace technology and utilize tools that can automate tasks, improve accuracy, and save you time.

Consider these options:

- Accounting Software: As mentioned earlier, QuickBooks, Xero, and FreshBooks are popular cloud-based accounting software options that offer a wide range of features.

- Mobile Apps: Many accounting software providers offer mobile apps that allow you to track expenses, create invoices, and manage your finances on the go.

- Online Banking: Most banks offer online banking platforms that allow you to track your transactions, download statements, and reconcile your accounts online.

2. Keep Organized Records: Your Financial Lifeline

Maintaining organized records is crucial for accurate bookkeeping. Here’s how to stay organized:

- Use a Filing System: Create a system for storing your invoices, receipts, bank statements, and other financial documents. You can use physical folders or digital file storage systems.

- Scan & Digitize: Scan important documents and store them digitally for easy access and backup.

- Cloud Storage: Consider using cloud storage services like Dropbox or Google Drive to store your financial data securely and access it from any device.

3. Regularly Review Your Finances: Stay on Top of Your Game

Don’t wait until tax season to review your finances. Make it a habit to review your bookkeeping records regularly. This will help you:

- Identify Errors: Catch any errors or inconsistencies in your records early on.

- Track Progress: Monitor your financial performance and identify areas for improvement.

- Make Informed Decisions: Use the insights from your bookkeeping data to make informed decisions about your business.

4. Seek Professional Advice: Don’t Be Afraid to Ask for Help

If bookkeeping feels overwhelming or you’re unsure about certain aspects, don’t hesitate to seek professional help.

Here are some options:

- Bookkeeper: A bookkeeper can handle your bookkeeping tasks, ensuring accuracy and compliance.

- Accountant: An accountant can provide more comprehensive financial advice, including tax planning, financial reporting, and business strategy.

Small Business Bookkeeping Template: Your Step-by-Step Guide

Now, let’s get practical. Here’s a simple bookkeeping template that you can use to manage your small business finances:

1. Chart of Accounts:

- Assets:

- Cash

- Accounts Receivable

- Inventory

- Equipment

- Prepaid Expenses

- Liabilities:

- Accounts Payable

- Loans

- Accrued Expenses

- Equity:

- Owner’s Equity

- Income:

- Sales Revenue

- Service Revenue

- Other Income

- Expenses:

- Cost of Goods Sold

- Salaries & Wages

- Rent

- Utilities

- Marketing

- Insurance

- Supplies

- Repairs & Maintenance

- Depreciation

- Interest Expense

2. Income & Expenses:

- Income:

- Create a separate spreadsheet or use accounting software to track all income received.

- Include the date, source of income (customer name, invoice number), and amount.

- Expenses:

- Create a separate spreadsheet or use accounting software to track all expenses incurred.

- Include the date, category of expense, vendor name, and amount.

3. Bank Reconciliation:

- Download Your Bank Statement: Download your bank statement from your online banking platform.

- Compare Transactions: Compare the transactions on your bank statement to your bookkeeping records.

- Identify Discrepancies: Note any discrepancies and investigate the reasons for them.

- Adjust Your Records: Make any necessary adjustments to your bookkeeping records to ensure accuracy.

4. Financial Statements:

- Income Statement (Profit & Loss Statement):

- Calculate your total revenue for the period.

- Calculate your total expenses for the period.

- Subtract your total expenses from your total revenue to determine your net income or loss.

- Balance Sheet:

- List your total assets.

- List your total liabilities.

- Subtract your total liabilities from your total assets to determine your equity.

- Cash Flow Statement:

- Calculate your cash inflows (money coming into your business).

- Calculate your cash outflows (money going out of your business).

- Subtract your cash outflows from your cash inflows to determine your net cash flow.

Bookkeeping Mistakes to Avoid: Don’t Fall into the Trap

Even with the best intentions, it’s easy to make mistakes when it comes to bookkeeping. Here are some common mistakes to avoid:

- Not Tracking Expenses: Don’t neglect to track your expenses. Every dollar counts!

- Mixing Business & Personal Finances: Keep your business finances separate from your personal finances. Use separate bank accounts and credit cards.

- Failing to Reconcile Your Bank Statements: Don’t skip bank reconciliation. It’s essential for accuracy and fraud detection.

- Not Keeping Up with Your Records: Don’t let your bookkeeping fall behind. Stay organized and keep your records up to date.

- Ignoring Professional Advice: Don’t be afraid to seek professional help when needed.

Bookkeeping for Different Business Models: Tailoring Your Approach

The specific bookkeeping needs of your business will vary depending on your industry and business model. Here are some considerations for different types of businesses:

- Service-Based Businesses: Focus on tracking your time, expenses associated with each project, and client payments.

- E-commerce Businesses: Track inventory levels, sales, shipping costs, and online payment transactions.

- Freelancers: Track your time, expenses, and invoices for each client.

- Non-Profit Organizations: Track donations, grants, and program expenses.

Conclusion: Bookkeeping: The Foundation for Financial Success

Bookkeeping might seem like a tedious task, but it’s an investment in your business’s future. By adopting a structured bookkeeping approach, you gain financial clarity, ensure tax compliance, attract investors, and unlock opportunities for growth.

Remember, your bookkeeping system should be tailored to your specific business needs. Embrace technology, stay organized, review your finances regularly, and don’t hesitate to seek professional advice when needed.

By mastering the art of bookkeeping, you empower yourself to make informed decisions, navigate the complexities of your business finances, and build a financially stable and successful future for your venture.

FAQs

1. What is the best bookkeeping software for small businesses?

There are many great bookkeeping software options available, such as QuickBooks, Xero, FreshBooks, and Wave. The best choice for you will depend on your specific needs and budget.

2. How often should I reconcile my bank statements?

It’s recommended to reconcile your bank statements at least monthly, but ideally, you should do it more frequently, such as weekly or even daily for high-volume transactions.

3. Do I need a separate bank account for my business?

It’s highly recommended to have a separate bank account for your business. This helps keep your business finances separate from your personal finances, making it easier to track income and expenses and ensuring tax compliance.

4. What are the best bookkeeping practices for e-commerce businesses?

E-commerce businesses should focus on tracking inventory levels, sales, shipping costs, and online payment transactions. They should also use a dedicated accounting software that integrates with their e-commerce platform.

5. How can I simplify my bookkeeping process?

Use accounting software, automate tasks, keep organized records, and seek professional help when needed. There are many resources available to help you streamline your bookkeeping process and save time and effort.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Small Business Bookkeeping Template: Your Guide to Financial Success. We appreciate your attention to our article. See you in our next article!